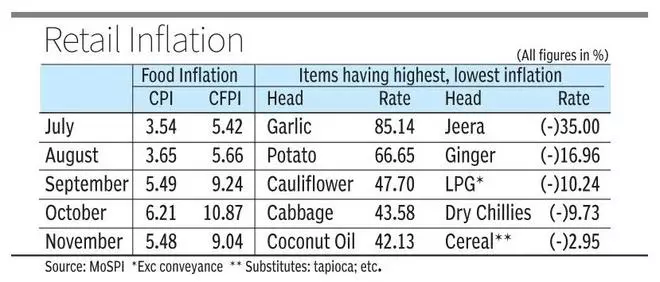

Decline in overall food and beverage inflation brought overall retail inflation, based on Consumer Price Index (CPI), down to 5.5 per cent in November from the October high of 6.2 per cent, government data released on Thursday showed. Experts said this brightens expectations of a policy rate cut in February.

Another dataset showed that better performance of manufacturing sector helped industrial growth measured in Index of Industrial Production (IIP) improve to 3.5 per cent in October against 3.1 per cent of September.

Inflation

Though vegetable prices, especially potato and cauliflower continued to be high, moderation in various food and beverage items helped cool inflation in November. Food prices are expected to come down further. According to Aditi Nayar, Chief Economist with ICRA, cumulative sowing of rabi crops exceeded the year-ago levels by 1.5 per cent by December 9, led by pulses, rice, wheat and coarse cereals whereas the rabi sowing for oilseeds contracted by 4.3 per cent.

“ICRA remains optimistic about the rabi crop, considering the favourable impact of high reservoir storage and the ensuing La Nina conditions on sowing and crop yields, even as the low inventory levels of DAP pose a concern,” she said.

Base effect, especially in vegetables, will bring the print down further in December. “A higher base effect of pulses, fruits, vegetables and spices inflation will be helpful in further decline in inflation in December, which we expect to be around 5 per cent,” said Paras Jasrai, Senior Analyst with India Ratings & Research (Ind-Ra). However, edible oils and personal care and effects may pose some challenge, he added.

Many believe that the inflation rate peaked in October and is now set to decline which, in turn, would result in a policy rate cut by the Monetary Policy Committee (MPC).

Rate cut likely

Suman Chowdhury, Chief Economist with Acuité Ratings & Research, said: “If the headline print continues its downward trend towards 4.5 per cent in the next 3 months, it could offer the central bank greater confidence to deliver its first rate cut in February.”

However, there are some risks too. Upasna Bhardwaj, Chief Economist, Kotak Mahindra Bank, said the November CPI inflation came broadly in line with expectations. While the 3Q average is expected to remain elevated, the winter crop arrivals may provide relief in the coming months. “We expect inflation to slowly inch towards RBIs medium term target of 4 per cent by mid- CY25 providing room for monetary easing from February policy. However, global environment and food price volatility will be key risks to the timing of the monetary easing cycle,” she said.

Leave a Comment