-

Ripple’s recent launch of the RLUSD stablecoin has marked a significant turn in its market presence despite slight fluctuations in XRP prices.

-

RLUSD’s impressive trading volume and market cap achievements suggest a growing trust in Ripple’s stablecoin innovation.

-

Analyst Arthur highlights Ripple’s strategic management of RLUSD’s supply to prevent drastic price drops, ensuring stability ahead of greater market adoption.

Ripple’s RLUSD stablecoin is swiftly becoming a contender in the crypto market, boasting remarkable trading volume growth while XRP experiences slight price changes.

RLUSD’s Prominent Position in the Crypto Market

Ripple’s RLUSD stablecoin has successfully captured attention, showcasing a self-reported market cap of $53.1 million, which underscores its emerging impact within the stablecoin sector. As of recent metrics reported by CoinMarketCap, RLUSD’s 24-hour trading volume skyrocketed an unprecedented 1,566% to reach $607.58 million, contrasting sharply with its competitors, such as PayPal’s PYUSD and Circle’s EURC. PYUSD holds a market cap of $491.72 million but only a trading volume of $19.74 million, while EURC trails behind with a market cap of $82.38 million and volume of just $10.55 million.

Understanding the Supply Management Strategy

Ripple’s careful management of RLUSD’s supply is a cornerstone of its strategy to maintain stability within a volatile market. Analyst Arthur’s observations reveal that Ripple is purposely controlling token release to manage liquidity and mitigate risks of value decline. This well-thought-out approach indicates Ripple’s foresight and could facilitate future demand and market position for RLUSD in the competitive landscape of stablecoins.

Source: Arthur/X

RLUSD’s Potential to Disrupt the Market

As it stands, RLUSD is emerging as a formidable competitor in the stablecoin space, currently ranking as the third most traded stablecoin, following Tether (USDT) and Circle’s USDC. Recently, Ripple’s CTO David Schwartz announced that RLUSD attracted bids as high as $1,200 per token, illustrating robust market interest. However, Schwartz reassured participants that all RLUSD tokens are redeemable at a $1 peg, with potential deviations expected to stabilize as liquidity in the market enhances post-launch.

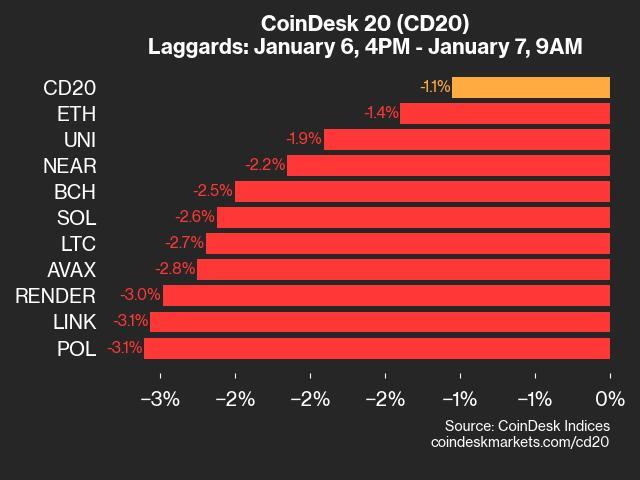

Analyzing the Ripple Effect on XRP Prices

Despite RLUSD’s growth, XRP itself has experienced some challenges, facing a slight decline of 4.19% in the past 24 hours, adjusting to $2.34, according to CoinMarketCap. This decline highlights the complexities at play as Ripple’s new stablecoin gains traction, suggesting that while RLUSD’s momentum is promising, its impact on XRP’s price action could be subtle and interwoven with broader market trends.

Conclusion

In summary, Ripple’s RLUSD stablecoin showcases significant momentum in the crypto market, boasting remarkable trading volume and a strategic supply management approach. However, XRP’s recent performance indicates that broader market dynamics still significantly influence its price. Moving forward, continued growth for RLUSD might align with Ripple’s long-term vision and reshape the stablecoin narrative for investors and enthusiasts alike.

Source: https://en.coinotag.com/ripples-xrp-experiences-price-variability-amidst-growing-adoption-of-rlusd-stablecoin/

Leave a Comment