Select real estate markets in India – across three southern states, namely Andhra, Telangana and Karnataka – and Pune are witnessing slower than expected residential real estate sales due to rising unsold inventory, says G Hari Babu, National President of NAREDCO (National Rea Estate Development Council).

According to him, luxury housing has done “extremely well in India”, but affordable home sales have slumped. Developers too have shied away from affordable housing projects as they find it unviable, under the present definition categories.

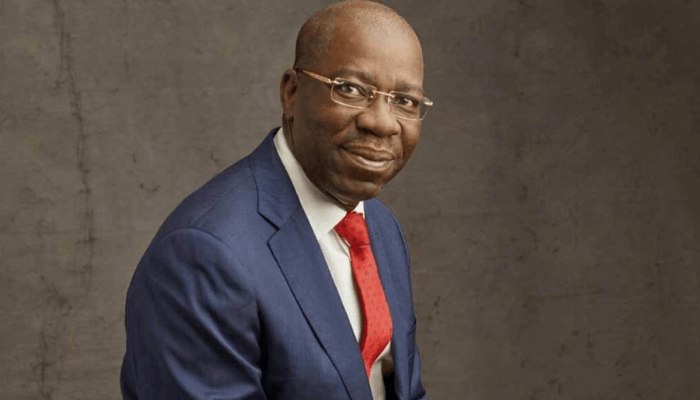

In an interview to businessline, Hari Babu talks about the outlook for FY25, the concerns around a looming slowdown in select markets, the slump in affordable housing sales and the need to make the category more realistically linked to market requirements.

What is the outlook for FY25?

In 2023 – 24, there was an increase in residential sales, around 16 to 18 per cent averaging it out across states. However, there are one or two states that are now showing some slowness; particularly, Telangana – is witnessing a slowdown for the last nine months or so, and Andhra Pradesh too.

Karnataka was reasonably okay, but there is some slowness over the last three -four months. And Pune is also a little slow. In some way, Gurugram is doing good, and Delhi is doing good. The opinion continues to be divided, but according to me, at least 12 per cent growth over FY24 is expected this fiscal.

Any particular reasons for why these four states are witnessing a slowdown?

In Hyderabad, the unsold stock is high. And then there was a change of government. Every time, there is a change of government, and for the first year at least, things are a little slow. Pune could be because of excess stock – many developers have come in and started projects in a big way there.

Whether this will continue or if things will take off depends upon the world economy too. Wars and economic slowdown are a reality. And many countries are in debt and their GDPs are coming down. The last recession was in 2008; and there is a 16 year cycle to it. Today is almost 16 yearsand so we have to keep a watch on that too.

So, is there some slowdown?

Yes, of course. For some 7 – 8 years residential real estate did well. Most of the players have now come in with new projects which are far bigger. Unsold stock inventories are there. In Maharashtra, the unsold stock is around 4 – 5 years, in Delhi it is only one year or around 14 months and in Hyderabad it is around 3.5 years. So, this unsold inventory is increasing, and there is slowness that has started.

Is the slowdown in IT leading to some trickledown effect on home sales?

IT cities will include Pune, Hyderabad and Bengaluru. Every year we are getting almost 50-60,000 jobs in Hyderabad. And 1.4 million jobs are created in Bengaluru. Pune follows next. But from the leasing point of view (by IT companies), there is some slow-down; and the overall sentiment is also slow. But it doesn’t mean, that the sentiment is negative.

When you say there is an eight-year rally in residential sales, what are these price points?

It’s the luxury segment that is doing good. This is a new phenomenon here in India. Luxury homes in terms of price would average out around ₹5 – 25 crore. But in select markets, may be Hyderabad, even ₹3 crore could be a luxury project.

However, if I were to explain luxury, then previously, a three-bedroom apartment used to be 700 – 800 sq ft or maybe 1,000 sq ft. Now luxury homes constitute 2,500 – 3,000 sq ft for a three-bedroom apartment. The other one is the construction site is also a luxury-one. Some of the projects have common areas which look like five-star lobbies, have clubhouses that look almost like big-star hotels, and so on. And people looking for these luxury properties are willing to spend more than ₹10,000 per sq ft for these amenities.

Who is buying the luxury properties?

It was previously said, 1 per cent of the population took away one-third of the wealth. But as economic growth happened, another 9 to 10 per cent people took away another one-third. It is that 10 per cent who are driving the luxury market.

Families are also upgrading. From three bed-room, people want to go for four bed-room apartments, and so on.

See, even the share of luxury to total housing portfolio has changed. Earlier in FY23, projects were around 50 – 50 between luxury and affordable; and in FY24 it changed to 60-40. Today, it is at least 70 – 30.

Andaffordable housing sales….

That segment is in very bad shape now.

When affordable housing started, some seven years back, the value was fixed at ₹45 lakh per unit. Today, for that same ₹45 lakhs, no builder can give an affordable house. So people are not constructing these homes.

Then there was Section 80 IBA (income tax benefit) which was offered to the developers. And after the first 3 – 4 years, they removed it.

Thirdly, it’s the interest rates. When we are talking about FY21, the home mortgage rates were at 7 – 7.25 per cent, and on that the government used to give interest subvention. That is gone now. And the interest rate is up at 9 per cent.

Naturally, then no developer is showing interest in affordable housing projects. For instance, in Hyderabad, affordable housing projects are down by 70 per cent. That is a huge number.

Have you taken this up with the government?

Yes. We requested two things – one is to increase the ₹45 lakh price bracket to a minimum ₹55 lakh. All that the Centre needs in this case is a paper notification.

And, number two, when price definition is revised to ₹55 lakh, you give the interest subsidy – first ₹25 lakh of the loan at a 5 per cent interest. And interest component on loans should be on fixed rates, not floating ones.

Over the last few, maybe 6 to 9 months period, we did see a lot of price rise in select markets. Is this sustainable?

Our real estate industry is serving only the top 10 per cent of Indians. And the top 10 per cent are becoming richer every year. And this 10% may increase to 15 or 20 per cent. But for the majority, real estate will still be out of reach. That is why you need affordable housing.

For instance, the average salary increase in Mumbai in the last 10 years is around 6.25 per cent. And this is lower than the GDP growth of the country. So money remains concentrated in the hands of a few.

Real estate’s contribution to GDP can be at 12 -1 3 per cent max. And if we want it to be around 25 per cent like that of China, then you end up creating ghost cities and ghost towns, with unfinished unoccupied spaces. So, overdoing real estate is also a bubble.

Published on December 27, 2024

Leave a Comment