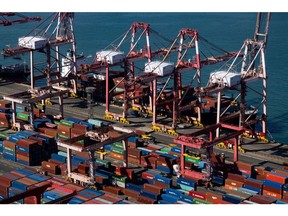

South Korea’s exports lost growth momentum in February as demand for semiconductors weakened and officials scrambled to engage the US in hopes of averting a hit from Donald Trump’s tariff campaign.

Article content

(Bloomberg) — South Korea’s exports lost growth momentum in February as demand for semiconductors weakened and officials scrambled to engage the US in hopes of averting a hit from Donald Trump’s tariff campaign.

Article content

Article content

The value of shipments adjusted for working-day differences decreased 5.9% from a year earlier, according to data released Saturday by the customs office. That compared with a 7.7% rise initially reported for January.

Advertisement 2

Article content

Despite more working days than last year, unadjusted exports grew just 1%, compared with a 3.7% expansion forecast by economists in a Bloomberg survey. Overall imports increased by 0.2%, resulting in a trade surplus of $4.3 billion.

Semiconductor shipments fell 3% from a year earlier, marking the first drop since late 2023, as conventional memory-chip prices declined, according to the Trade Ministry. Semiconductors are South Korea’s biggest driver of earnings from abroad.

With an economy heavily reliant on trade, South Korea is among the nations most vulnerable to protectionist policies. Trump’s plans to escalate tariffs and bring more production back to the US pose a risk to a range of South Korean companies deeply embedded in global supply chains, including Samsung Electronics Co., and automakers such as Hyundai Motor Co.

Acting President Choi Sang-mok on Friday spoke with US Treasury Secretary Scott Bessent and requested that Washington take into account South Korea’s contributions to the US economy when it puts together policies including reciprocal tariffs that have been flagged by Trump. Separately, Ahn Duk-geun, Minister of Trade, Industry and Energy met with Commerce Secretary Howard Lutnick and the two agreed to form working groups to discuss the charges and shipbuilding cooperation, his ministry said Saturday in a statement.

Article content

Advertisement 3

Article content

Trump last month signed a measure to look into new levies on a country-by-country basis, and Lutnick said all studies should be complete by April 1. The US president has also ordered 25% tariffs on steel imports and floated the idea of the charges on semiconductors and automakers, key drivers for South Korea’s economy.

Chey Tae-won, chief of SK Group, which includes a memory-chip supplier to Nvidia Corp., led a delegation of business executives to the US last month, meeting with policymakers and legislators who could help South Korean companies better position themselves before Trump’s trade policies take effect.

“Exports have kept the economy from slipping into recession in recent quarters, and the boom in artificial intelligence should sustain shipments of advanced memory chips,” Dave Chia, a Moody’s Analytics economist, said. “However, a slowdown in other major categories and new tariffs in the US following the recent change in administration stand to limit export growth.”

The US is South Korea’s foremost ally and provides security guarantees against North Korea. Its imports from the Asian nation have risen in recent years, making Seoul more vulnerable to tariffs from the US. China, South Korea’s biggest trading partner, is also bracing for rising tensions with the US.

Advertisement 4

Article content

Trade risks have risen at a time when President Yoon Suk Yeol’s short-lived declaration of martial law in December has battered consumer confidence. Yoon was later impeached and arrested on charges of insurrection, and a court is reviewing whether to permanently oust him or put him back in office.

Prime Minister Han Duck-soo was also impeached by an opposition-led parliament, and Finance Minister Choi has since been leading the government. In that role, Choi has been negotiating the specifics of an extra budget that could help prevent a further slowdown in economic momentum.

South Korea’s main opposition Democratic Party has proposed drafting an extra budget plan worth as much as 35 trillion won ($24 billion) as it tries to position itself as the driver of support measures. Meanwhile, Bank of Korea Governor Rhee Chang-yong suggested the package should be worth between 15 trillion won and 20 trillion won.

The BOK last month cut its benchmark interest rate to support the economy while also downgrading its economic forecast for this year to account for concerns about trade risks, slowing consumption and domestic political turbulence. The central bank made the move even as it’s been wary about the risk of putting further downward pressure on the local currency. Asia’s weakest performer last year, the won has taken a further hit from Trump’s protectionist pledges.

Article content

Leave a Comment