The initial public offering of Standard Glass Lining opens today for public subscription at a price band of Rs 133-140. The ₹410.05-crore IPO is a mix of a fresh issue worth ₹210 crore and an offer to sell up to 1.43 crore shares by Promoter Selling and Promoter Group Selling Shareholders and Other Selling Shareholders. Investors can bid for a minimum of 107 shares and in multiples of 107 thereafter.

Up to 35 per cent of the issue has been reserved for retail investors, 50 per cent for QIB s and the balance 15 per cent for high net worth individuals.

Share of Standard Glass Lining will be listed on the BSE and the NSE.

As part of its IPO, the company raised Rs 123 crore from anchor investors. In a disclosure to the stock exchanges, Standard Glass said it had allocated 87,86,809 shares at ₹140 a share to anchor investors.

Among the foreign and domestic institutions that participated in the anchor were Amansa Holdings Private Ltd, Clarus Capital I, ICICI Prudential MF, Kotak Mahindra Trustee Co Ltd A/C Kotak Manufacture In India Fund, Tata MF, Motilal Oswal MF, 3P India Equity Fund I, Kotak Infinity Fund—Class AC, Massachusetts Institute of Technology, and ITI Large Cap Fund.

According to DRHP, the company plans to utilise the proceeds from its fresh issuance to the extent of ₹10 crore will be used for funding of capital expenditure requirements of the company towards the purchase of machinery and equipment; ₹130 crore for repayment or prepayment, in full or in part, of all or a portion of certain outstanding borrowings availed by the company and investment in its wholly owned Material Subsidiary, S2 Engineering Industry Private Limited, for repayment or prepayment, in full or in part, of all or a portion of certain outstanding borrowings availed by S2 Engineering Industry Private Limited, from banks and financial institutions; ₹30 crore for investment in its wholly owned material subsidiary, S2 Engineering Industry Private Limited, for funding its capital expenditure requirements towards the purchase of machinery and equipment; ₹20 crore for funding inorganic growth through strategic investments and/or acquisitions; and general corporate purposes.

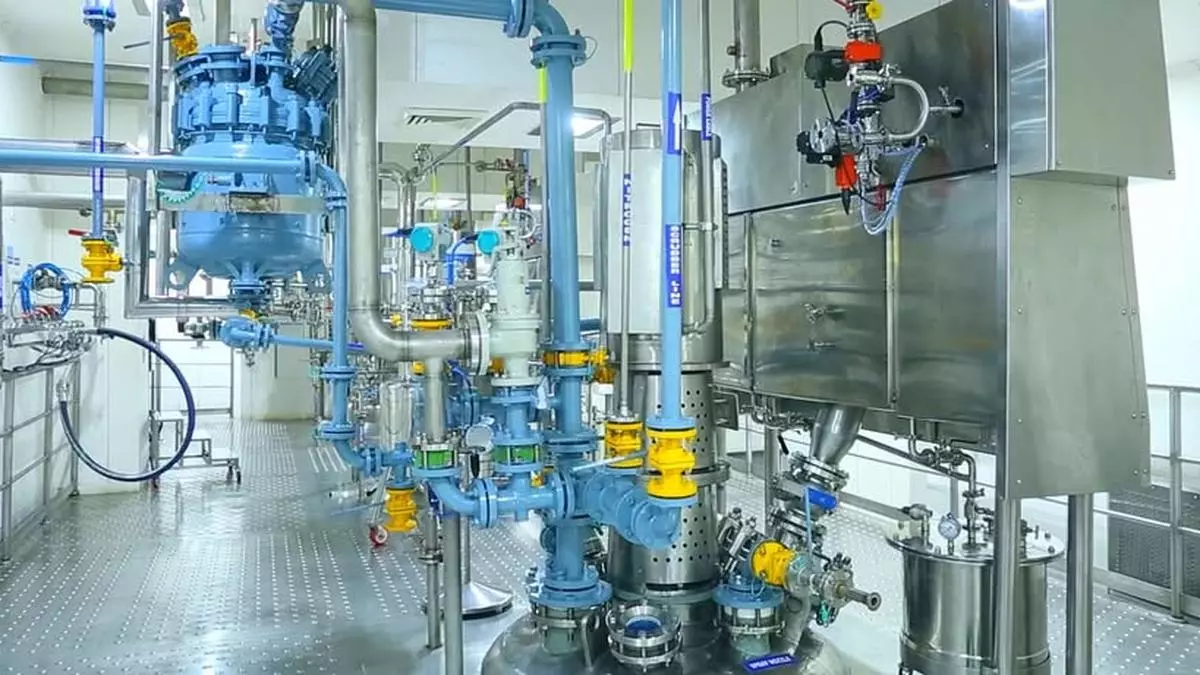

Standard Glass Lining Technology’s capabilities include designing, engineering, manufacturing, assembly, installation, and commissioning solutions and establishing standard operating procedures for pharmaceutical and chemical manufacturers on a turnkey basis. Its portfolio comprises core equipment used in manufacturing pharmaceutical and chemical products, which can be categorised into Reaction Systems, Storage, Separation, Drying Systems, and Plant, Engineering, and Services (including other ancillary parts). It is also one of India’s top three manufacturers of glass-lined, stainless steel, and nickel alloy-based specialised engineering equipment in terms of revenue in Fiscal 2024, according to an F&S Report. It is also one of India’s top three suppliers of polytetrafluoroethylene (“PTFE”) lined pipelines and fittings in terms of revenue in Fiscal 2024. It has been the fastest-growing company in the industry and has operated during the past three completed fiscals in terms of revenue.

The company has in-house capabilities to manufacture all the core specialised engineering equipment required in the active pharmaceutical ingredient (API) and the manufacturing of fine chemical products. Over the last decade, it has supplied over 11,000 products. Its marquee customer base includes 30 out of approximately 80 pharmaceutical and chemical companies in the NSE 500 index as of June 30, 2024. It operates through its eight manufacturing facilities spread across a built-up/floor area of over 400,000 sq. ft., strategically located in Hyderabad, Telangana, the “Pharma Hub” of India, which accounted for 40.00% of the total Indian bulk drug production in Fiscal 2024.

IIFL Capital Services Limited, and Motilal Oswal Investment Advisors Limited are the book-running lead managers, and KFin Technologies Limited is the registrar of the issue.

Leave a Comment