Happy New Year’s, everyone!

This time of year is the perfect opportunity to start fresh, to evaluate the past year, and to work toward accomplishing new goals. In other words, it’s a time to think about our future.

That process includes a reflection about our family. Whether it’s your extended family, a committed partner, perhaps your children, or whatever it may be, the most important goals usually involve the family unit.

That means doing what you need to protect your family.

It’s the season to, once again, make sure everything is set up to ensure our families have the secure future they deserve. Today, we’ll explore some essential things you can do today to protect your family’s future.

Get Your Estate In Order

Those of us in the medical field have witnessed firsthand that everything can change in an instant. It’s a tough reality of the job.

In fact, I received some unfortunate news recently. Somebody I knew—they were older, in their eighties—just passed away. It was tough, but I was happy to know them and then have the opportunity to celebrate their life. When I was catching up with their family members, it turns out that my friend never set up a will. That was a bit shocking to hear, especially because his net worth was in the nine-figures.

My friend’s story is not unique. Many people never make the move to set up their estate and make plans for how assets will pass on. I get it. We think that we’re going to live long lives. Accidents or sudden medical emergencies are things that happen to other people. For whatever reason, it’s easy to ignore the reality that the unexpected could happen at any time.

It’s my hope that we all live a very long time and live on our own terms, but we should always plan for the unexpected. What would happen to your family, financially speaking, if you were to die today?

If you want to ensure a secure future for your family, that includes making sure your estate is set up as seamlessly as possible.

Setting Up a Living Trust

One popular way of planning for what happens to all of your assets is a living trust, which is similar to a will. The trust, however, is a much heavier document. It can go into detailed directives and instructions that are carried out when you pass away.

It requires that you assign a trustee—somebody who carries out the directives of the trust. Based on your instructions, this individual will ensure that your beneficiaries are taken care of.

And you’d be surprised how detailed you can get with the instructions. For example, you can direct beneficiaries to receive assets all at once, after a milestone (like their eighteenth birthday), or in increments over time.

Without a living trust, it’s a lot easier for things to be contested in court. That gets uncomfortable fast, becoming a free-for-all when it comes to beneficiaries making claims for your assets. That’s when courts get involved and a lot of unwanted in-fighting enters into the lives of your family. But courts and probate can also be needlessly expensive. And don’t forget that avoiding court keeps things out of the public sphere.

Avoid all of that by being intentional about your estate from the beginning. You set it up once, but you can do maintenance on it whenever you’d like.

Consider Life Insurance

This is likely a no-brainer for everyone reading this.

Taking out a life insurance policy is another great way to protect your family’s future.

If you were to pass away, and your family’s expected income changes, you can ensure their future security by providing them with assets that offset that income loss. Again, this is crucially important if you are the primary breadwinner of the family.

The biggest question I get asked about life insurances is this: How much should I get? That depends on your assets, your home, your expected income until retirement, and what you want to have covered.

But here are some basics. Most people like to make sure a life insurance policy will cover their debts—think mortgage, medical school debt, and things like this. This ensures that your family has a place to live and is not on the hook for any debt you leave behind.

In addition to that, many people will also include around 10 years’ worth of their annual salary. This helps take care of your family’s future by ensuring at least some of your expected income before retirement.

There are a lot of options when it comes to life insurance, and I don’t want to go too much into the weeds. But “term” life insurance—where it’s set for a specific amount of time, like 20 or 30 years—is very affordable when compared to other options.

Life insurance gives you peace of mind that if anything were to happen to you, your family’s future will be secure.

The Importance of Disability Insurance

As physicians, our most precious income-generating asset is our hands and mind. Your ability to generate income is dependent on your physical body.

If you get sick or injured, you may experience a substantial loss of income. With disability insurance, that sudden loss of income would be mitigated by your policy.

I know that many of us are working on being self-insured—or having created enough income streams through investments that, if something were to happen, their family would continue to get income. But if that doesn’t describe you or if you are still working toward that, then you should consider disability insurance.

Keep Your Documents Organized

All of your important documents should be easily located as needed. This includes your trusts, deeds, tax letters, insurance agreements, passwords, and more. For me, I’ve turned to digitizing almost all of these. It’s just easier for me to throw them in a digital vault.

Even on paper, you want to have them all in a defined area that is easy for you or beneficiaries to access when needed. Maybe that’s a safe deposit box, a fire-proof safe, or somewhere else that has high security.

Your partner and beneficiaries will be happy you kept everything organized. Nobody will have to go scrambling for them. And think about tax time. When you have everything organized, it’s a much better process.

Keep Your Investments Organized

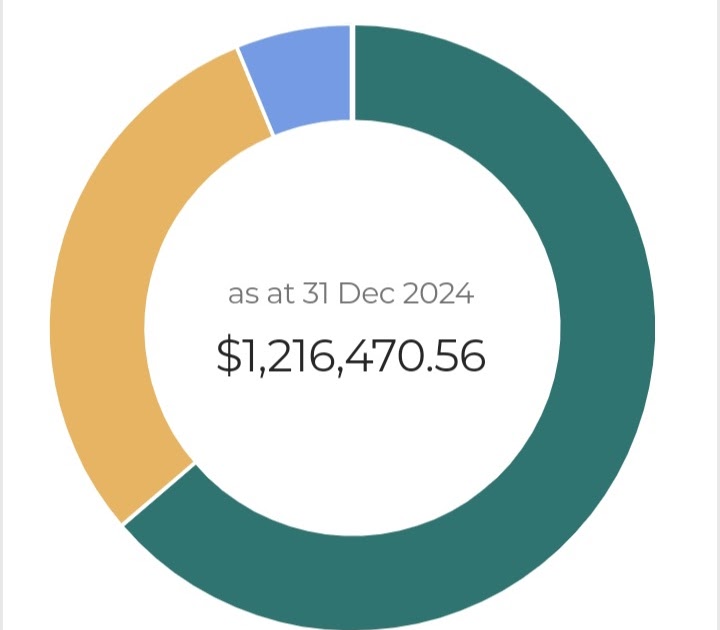

If you’re like me, you’re investing in multiple asset classes on multiple platforms. There’s syndications, crypto, Robinhood, Fidelity, Vanguard, and so much more.

How is your beneficiary supposed to know where all of the assets are if something happens to you? Make sure you have a master list of your investments.

Something to consider is giving your CPA access to this list. Then tell your beneficiaries that your CPA will be their point person. Knowing where all of your investments are will help ensure your loved ones know how to sift through everything.

Review Everything with Your Beneficiaries

New Year’s isn’t just a time for you to review everything, it’s also a great time to involve your partner, family, and/or beneficiaries. And don’t make this a one-off. Do this on a regular basis.

But even if it’s just once a year, remind everyone where things are located, how to access important documents, and anything else they might need to know. Also review your portfolio with them. This is how much the trust grew this year. This is what we did with investments this year. These are the goals for the year. Like a pilot before takeoff, go through the checklist.

The more you do this, the more prepared your family will be. And you’ll rest easy knowing your family’s future is protected.

Be a Provider and a Protector

Reflecting and reviewing what’s necessary to protect our family’s future isn’t usually at the front of our mind. Instead, we tend to view our role as bringing in good income, making great investments, and creating awesome memories and experiences for our family.

But what gets lost in that is the actual protection—the backstop—that ensures your family will have a secure future in case something unexpected happens. And when you take the time to create these protections, a fantastic thing happens: peace of mind. You won’t have to worry about tomorrow so that you can live for today.

Make securing your family’s future a New Year’s resolution. Once you do it, you’ll feel so good about yourself. With that peace of mind, you can go on living your dream life.

That’s all for today. Happy New Year, everybody! Thanks for stopping by. I hope you feel inspired to protect your loved ones and give them the foundation to thrive. See you again soon!

Peter Kim, MD is the founder of Passive Income MD, the creator of Passive Real Estate Academy, and offers weekly education through his Monday podcast, the Passive Income MD Podcast. Join our community at the Passive Income Doc Facebook Group.

Leave a Comment