How often have we heard the age-old investing motto, ‘If you want to earn higher returns, you must take higher risk’? Probably a lot. However, there is clear evidence that this theory is wrong. You can earn high returns by taking low risk — the exact opposite of what is commonly believed.

High-risk high-return

To understand why the high-risk high-return theory is wrong, we need to take a small detour to its origin. In 1964, William Sharpe developed the Capital Asset Pricing Model (CAPM), building on the earlier work done by Harry Markowitz. As per CAPM, the expected return from a stock is dependent on its beta, where beta measures the stock’s sensitivity to the overall stock market.

CAPM proposed that the return from a stock is dependent on one factor alone – its beta. Higher the beta — higher the sensitivity or volatility of the stock — higher will be its expected return. This model provided the perfect foundation for the high-risk high-return idea. It predicted that high beta stocks, which are risky due to their higher volatility, will earn higher returns.

Chinks in CAPM

The advent of CAPM led to an outburst of research confirming its findings. But there were also occasional studies which presented counterviews. One of the earliest studies to doubt the findings of CAPM was published in 1972 by Robert Haugen and James Heins. This study concluded that there was actually very little evidence that investing in risky stocks is rewarded with higher return.

Such studies, which contradicted CAPM, were mostly ignored. However, a seminal paper by Eugene Fama and Kenneth French, published in 1992, dealt a fatal blow to CAPM. In this paper, the authors introduced the Fama-French Three Factor Model, which dethroned beta as the only factor that explains stock returns and added two more factors — the value factor and the size factor.

The 1992 paper by Fama-French opened the floodgates for research on what other factors influenced stock returns. In the quest for uncovering new factors, researchers noticed a surprising paradox — low-volatility stocks were exhibiting superior return performance, the exact opposite of what we would expect.

The evidence

The most comprehensive evidence on the low-volatility paradox has been compiled by Pim van Vliet, Head of Conservative Equities at Robeco Quantitative Investments, and a global authority on low-volatility investing.

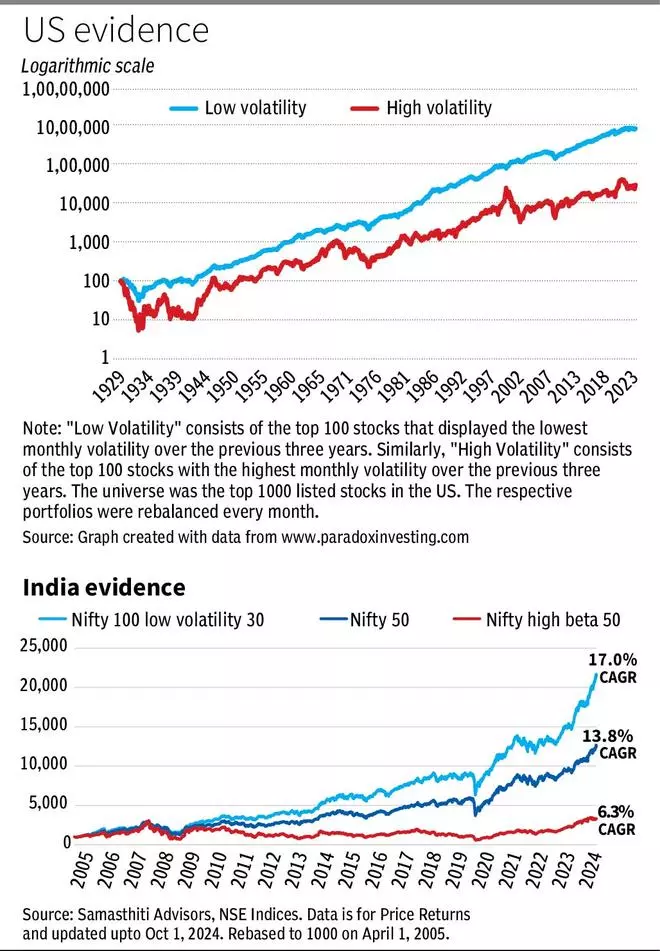

Going all the way back to 1929, Pim compiled a low-volatility portfolio and a high-volatility portfolio. The difference in returns between the two portfolios is astonishing.

An amount of $100 invested in 1929 in the low-volatility portfolio grew close to $10 million by the end of 2023. A similar amount invested in the high-volatility portfolio grew to only about $33,000. The difference is staggering. Low volatility delivered a CAGR of 10 per cent, while high volatility barely delivered a 6.5 per cent CAGR.

Other researchers have observed the low-volatility paradox in different geographies and different asset classes. A prominent study, “Betting Against Beta”, published in 2011, found this effect in “18 of 19 international equity markets, in Treasury markets, for corporate bonds sorted by maturity and by rating, and in futures markets.”

We have evidence of low-volatility paradox in India as well. For our purpose, I have selected two indices — Nifty 100 Low Volatility 30 and Nifty High Beta 50. The Low Vol 30 index selects 30 stocks from the Nifty 100 universe displaying the lowest volatility, while the Beta 50 index selects 50 stocks from the Nifty 100 universe with the highest beta. These indices provide a very good head-to-head competition between low-risk and high-risk investing. The gap between Low Vol 30 and Beta 50 is, again, astonishing. Low Vol 30 delivered 17 per cent CAGR over close to a 20-year period, beating Beta 50’s 6.3 per cent CAGR.

Conclusion

There are several reasons why, despite the evidence, low-volatility investing remains obscure. The most important reason has to do with investor behaviour. Paul Samelson, who inspired John Bogle to create index funds, had remarked, “Investing should be more like watching paint dry or watching grass grow. If you want excitement, take $800 and go to Las Vegas.”

Low-volatility investing is like watching paint dry or watching grass grow — not an easy thing to do. Imagine holding on to a bunch of boring stocks that don’t move much on a daily basis, while your friends could be investing in volatile stocks that promises to be the next big thing.

Research suggests that most investors view their investments as a lottery. We invest not to benefit from the slow grind of long-term compounding, but to earn outsized returns in the short term. You must have heard of the hare and tortoise story in your childhood. Unfortunately, as investors, we behave more like the hare rather than the tortoise.

Low-volatility investing is for the tortoises amongst us – and yes, as data show, they do win the race!

The writer is a SEBI Registered Investment Adviser (RIA) and Co-founder of www.samasthiti.in

Leave a Comment