Taxpayers including senior citizens with earnings about to exceed ₹12 lakh can invest in tax-free bonds to confine their taxable income within rebate limits.

In a significant update, Budget 2025 revamped the new income tax regime, raising the tax-free threshold from ₹7 lakh to ₹12 lakh (after considering rebate). Additionally, with a standard deduction of ₹75,000, taxpayers (including pensioners) earning up to ₹12.75 lakh annually do not need to pay tax.

Income from other sources such as interest earned on taxable bonds, small savings schemes and fixed deposits, can at times become less appealing for investors earning over ₹12 lakh. This is because the interest income is added to their taxable income, potentially pushing their total income beyond the ₹12.75 lakh threshold and causing them to lose the rebate benefit.

In contrast, tax-free bonds offer a significant advantage, as the interest income from these bonds are tax-free, and not included in taxable income. This helps investors maintain their total income within the rebate limit, ensuring they retain the tax benefit paying no tax. (Marginal relief has not been factored in).

Senior citizens with taxable income slightly over ₹12 lakh can plan it accordingly by parking the portion of their existing retirement corpus or future surplus in tax-free bonds to keep their taxable income within the rebate limit.

There are tax-free bonds that were issued in the past now tradable in the cash segments of exchanges like the BSE and NSE. Some of these bonds are actively traded with decent liquidity and available with up to 11 years residual maturity. Despite the current yields from the tax-free bonds are ranging from 5.5-5.9 per cent, they are lucrative options for conservative investors who seek capital safety and regular income.

What are tax-free bonds?

Between 2012 and 2016, 14 state-owned infrastructure finance companies, such as the National Highways Authority of India (NHAI), Indian Railway Finance Corporation (IRFC), and Power Finance Corporation (PFC), issued secured tax-free bonds. These bonds had tenures of 10, 15, and 20 years, with annual interest payments. Most were rated ‘AAA’ by credit rating agencies, indicating high safety.

All tax-free bond series are listed on the BSE and NSE. Of the 193 series issued, 57 have matured, leaving the rest available for trading with residual maturities of up to 11 years.

Interest earned from these bonds is entirely tax-free. Since they are issued by government-backed entities, they are considered low-risk. This makes them an appealing choice for investors prioritising capital preservation and steady income.

How to choose the right tax-free bonds?

While buying tax-free bonds from the secondary markets, investors should identify bonds with high liquidity and attractive yields to maturity (YTM).

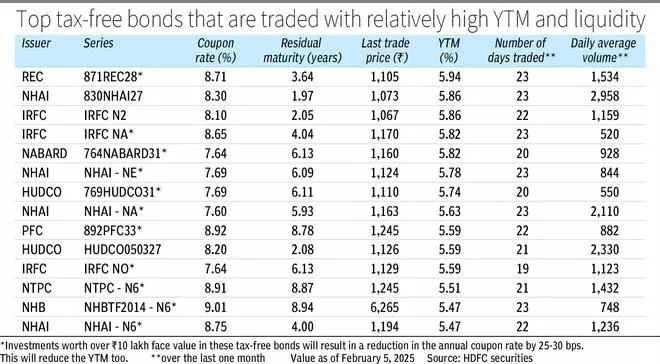

Liquidity or traded volume plays an important role while buying bonds from the secondary markets. Bonds with higher liquidity can be purchased at better prices, while illiquid bonds may result in lower yields due to higher acquisition costs. As per the data sourced from HDFC Securities, while most bond series have low trading volumes, around 20 of them offer relatively higher YTMs and reasonable liquidity. For example, the REC bond series ‘871REC28,’ issued in 2014 with an 8.71 per cent annual interest rate, recently traded at a YTM of 5.9 per cent with an average daily volume of 1,534 units over the past month.

Attractive yields

When purchasing bonds from the secondary market, investors should focus on Yield to Maturity (YTM) rather than the market price. YTM represents the annualised return an investor can expect if the bond is held until maturity. HDFC Securities data show that 15 tax-free bond series are trading with YTMs between 5.5 per cent and 5.9 per cent.

In comparison, AAA-rated corporate bonds offer yields of around 7.4 per cent, and five-year fixed deposits from PSU banks provide senior citizens with up to 8 per cent annually. However, as interest from corporate bonds and bank FDs is taxable, post-tax returns for investors in the highest tax bracket (maximum marginal rate of 43 per cent under old regime and 39 per cent under new regime) drop to around 4.6-5.1 per cent.

Individuals in lower tax brackets may too find taxable instruments worth considering due to the lower and no impact of taxes on their returns.

The debt market is becoming attractive as interest rates peak, making it a favourable time to secure higher yields from quality debt instruments. Tax-free bonds are always a sound investment option due to their tax benefits and no investment limits (by purchasing multiple ISINs). Additionally, as no new tax-free bonds are being issued, their limited availability in the secondary market enhances their value as a valuable portfolio addition. Investors should select bonds with residual maturities that align with their investment horizon and hold them until maturity. To purchase these bonds on stock exchanges, a demat account is required.

Leave a Comment