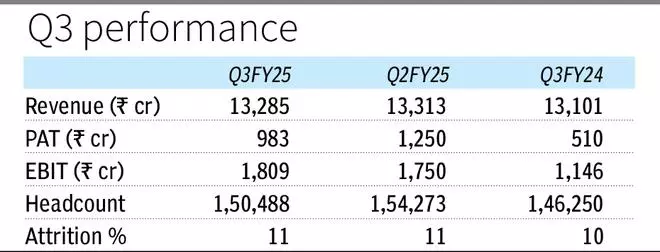

Tech Mahindra’s net profit dropped 21 per cent sequentially at ₹983 crore in the December-ending quarter while adjusted profits excluding land sale proceeds in the previous quarter rose 11.5 per cent driven by new deal wins. Revenue was almost flat at ₹13,285 crore and EBITDA rose by 3.4 per cent on a quarterly basis to ₹ 1,809 crore.

On a yearly basis, profit increased by 92 per cent, revenue increased by 1.4 per cent and EBITDA rose by 57.8 per cent. Choosing to focus on the operational profits and EBITDA margins, Rohit Anand, Chief Financial Officer of Tech Mahindra, said, “We delivered growth in EBIT margin and operating PAT, both on a sequential and year-on-year (y-o-y) basis, resulted from our targeted actions under Project Fortius, along with steady increase in new deal wins, across prioritised verticals and markets. Our continued focus on optimising working capital management has resulted in generation of robust free cashflow.”

In US dollar, net profit decreased by 22 per cent sequentially and revenue dropped by 1.3 per cent. EBITDA margins went up 40 bps to 13.6 per cent sequentially. Annually, profits went up by 88.5 per cent, revenue went down by 0.4 per cent and EBITDA margins went up by 480 bps.

Improved deal wins

Mohit Joshi, Chief Executive Officer and Managing Director of Tech Mahindra, said, “We see an improved rate of deal wins in our key verticals and priority markets. This coupled with consistent expansion in operating margins, despite cross-currency headwinds during the quarter, reaffirms that we are on track to achieve our long-term goals.”

- Also read: IHCL reports 29% surge in Q3 profit, reaching ₹582 crore

The company reported a headcount 150,488 employees by the ending of the quarter, less the previous quarter by 3,785 individuals. The attrition rate grew to 11.2 per cent.

Earnings per share

It generated a free cash flow of $199 million and had ₹6,840 crore by the end of the quarter. Earnings per share stood at ₹11.08, less than the ₹15 per share reported last quarter.

The company was selected by a large German Telco to support their technology domains across Network, IT, and Service Operations, and a global leading Hi-Tech and mobile company for the end-to-end data services. The company also won managed services deal from a European auto-maker. It was also selected by one of the largest telco in Canada to provide frontline customer experience services.

Leave a Comment