Among the top-five Indian IT services companies in terms of revenue, Tech Mahindra has been one of the better performers over the last one year with its 42 per cent returns, outpacing that of peers like TCS and Infosys. Since our buy recommendation on the stock in April 2021, the stock is up 89 per cent and here, too, has outperformed peers like TCS, Infosys and Wipro, which have returned 44 per cent, 50 per cent and 30 per cent, respectively, in the same period.

Only HCL Tech has performed better amongst the top 5 players with 106 per cent returns since April 2021. In our edition dated December 1, 2024, we had highlighted why HCL Tech is likely to be an underperformer from now versus peers given the significant re-rating that has played out in its stock in recent years. Similar to that, we believe the re-rating has played out in Tech Mahindra as well and, hence, recommend investors to book profit in the stock after its outperformance since our buy recommendation.

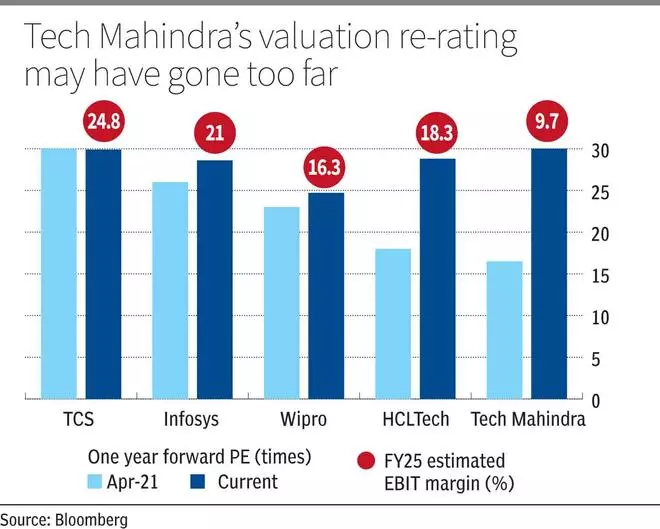

When we recommended a buy, Tech Mahindra was trading at an attractive valuation of one-year forward PE of 16.5 times. This presented a good opportunity for investors then, given its comparable earnings and revenue growth with top peers, but cheaper valuation. Post the run-up in the stock, it trades at 30 times today.

Investors face the risk of contraction in valuation multiples from here. Positives of strategic initiatives announced over the last year are fully factored and the stock is expensive on an absolute as well as on a relative basis.

Turnaround plan

The recent share performance of Tech Mahindra has been buoyed by strategic initiatives introduced by the management under MD and CEO Mohit Joshi, who took over from IT industry veteran CP Gurnani in December 2023. The strategic plans under Vision FY27 target the company growing revenue greater than average of its peers and reaching industry-standard margins. Initiatives include driving growth in prioritised markets and focus on large deals to push revenue. Currently, Tech Mahindra’s business vertical is differentiated versus peers with 33 per cent of revenue from its largest vertical — Telecom, compared with close peers that have BFSI as their largest vertical and contributes to over 30 per cent of revenue. The company intends to maintain its leadership position in telecom, while at the same time grow its presence in the BFSI vertical (15-16 per cent of revenue now) with differentiated offerings. On the cost side, the company aims to bring in efficiencies by right-sizing pyramid structure to optimise talent utilisation. The company is also making focused investments in AI and has also embarked on building a large language model (LLM). Although for now the view is divided on building LLMs in India, with Infosys founder NR Narayana Murthy triggering a debate by noting that investing in building LLMs in India may not make sense due to many constraints.

Nevertheless, one of the key factors to be noted from these initiatives of Tech Mahindra is its intent to reach 15 per cent in EBIT margins by FY27. In recent years, Tech Mahindra’s margins have taken a hit due to a combination of company-specific and industry-related factors. From 11.4 per cent in CY23, EBIT margin declined to 6.1 per cent in FY24. It is estimated to move up close to 10 per cent in FY25 and to 15 per cent by FY27.

Many positives, but the problem lies in its valuation. At a one-year forward PE of 30 times, Tech Mahindra is trading on par with TCS and at a marginal premium to Infosys and HCL Tech. Even assuming it reaches 15 per cent margins by FY27, which is not a given and will face challenges, its margins would still be much lower than that of TCS, Infosys and HCL Tech whose EBIT margins are much higher currently at around 24.5 per cent, 20.5 per cent and 18 per cent, respectively.

Further, its peers, too, are strategising at different levels to grow in the new AI-driven tech era and are equally focused on improving revenues and gaining market share. So in a way, it is a case of red ocean strategy in the IT sector, where a lot of competent, high-quality companies are fighting it out to do better than the other.

Factoring these, with shares already more or less fully factoring the turnaround prospects, there is no margin of safety and risks are to the downside. This apart, there are also risks from an industry slowdown, driven by an economic slowdown in the US in CY25. Hence, it is prudent to book profits after outperformance and rerating.

Recent performance

For Q2FY25, the company reported revenue of ₹13,313 crore, up 3.5 per cent year on year and EBIT of ₹1,280 crore, up 112 per cent. EBIT margin at 9.6 per cent, rebounded from a low of 4.7 per cent in Q2FY24. While growth remains weak, the results were better than consensus estimates on the margin front.

For full FY25, consensus estimates indicated revenue growth of 2.9 per cent and earnings growth of 66 per cent, aided by strong rebound in margins. It is important for investors to note here that the one-year forward PE mentioned above factors for the strong margin/earnings improvement in FY25 and also for much of FY26.

Leave a Comment