India’s home-grown Unified Payments Interface (UPI) has seen exponential growth since its launch in 2016. Last month, there were 16.73 billion UPI transactions worth ₹23.25 lakh crore. Transaction volume rose 39 per cent year-on-year (YoY), while value rose 28 per cent. On average, 540 million UPI transactions worth nearly ₹75,000 crore were registered daily in December.

Seven foreign countries — France, Singapore, UAE, Sri Lanka, Bhutan, Nepal and Mauritius — now accept UPI payments. According to reports, this year may see UPI going live in Qatar, as also Thailand and other countries in the Southeast Asian region. Furthermore, Peru, Namibia and Trinidad and Tobago have also partnered with the National Payments Corporation of India (NPCI) to launch a UPI-like system.

Domestically, 641 banks — including private, public sector and urban co-operative lenders — are currently live on UPI. Forty third-party apps support the backbone of the UPI technology. Importantly, the technical decline rate of UPI transactions, which refers to transaction failure on account of network or IT issue at the banks’ and NPCI end, has fallen dramatically.

For large banks like State Bank of India and HDFC Bank, the technical decline rate in December 2024 stood at 0.48 per cent and 0.09 per cent, respectively, reflecting the growing efficiency of bank servers as they handle billions of transactions each month.

According to a paper by the European Payments Council, there are 350 million active UPI users in India and over 340 million QR codes at merchant locations to facilitate digital payments.

Additional features introduced by the NPCI — such as UPI Lite, UPI 123PAY, Hello! UPI, and credit line on UPI — are expected to further cater to a diverse audience and propel the ecosystem’s future growth.

Limiting volumes

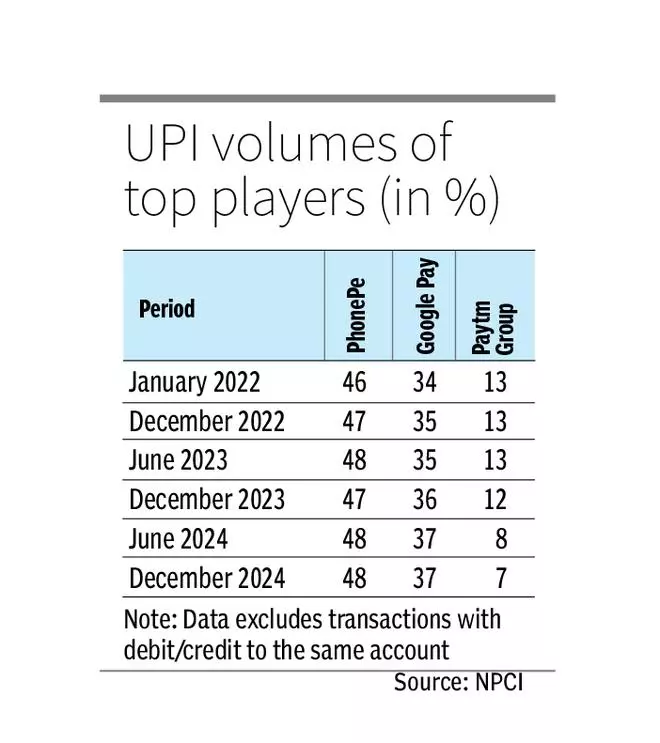

Despite the overwhelming success of UPI domestically, concerns have emerged over the concentration of volumes. The top two players — Walmart-backed and IPO-bound PhonePe; and Google Pay — together account for about 85 per cent of transaction volumes. Paytm follows with around 7 per cent share.

Given the concentration risk, the NPCI had in 2020 issued guidelines limiting transactions initiated through a third-party app provider (TPAP) to 30 per cent of the overall UPI transactions in the preceding three months (on a rolling basis). The cap was meant to take effect from January 1, 2021, giving TPAPs with excess volumes two years to comply.

However, in 2022, the NPCI extended the deadline to December 2024 after taking into account the existing usage and future potential of UPI. Even as smaller players waited for the cap to kick in last year, the NPCI yet again extended the deadline to December 2026.

Processing fee

According to people familiar with the matter, it would be difficult to impose a market cap at this stage as there is no merchant discount rate (MDR) on UPI transactions. MDR is a fee that businesses pay to a payments processing company for each transaction made using a debit or credit card.

“Smaller players are not able to raise money. To acquire market share you need funds. Until there is a decision on MDR, the market cap may not benefit smaller players,” a source said. Enabling MDR on UPI transactions will significantly aid fintech companies in raising bigger funds.

Separately, the NPCI allowed the launch of a record 20 new UPI apps in 2024. It also removed the UPI customer onboarding restriction on WhatsApp, as part of efforts to curtail the dominance of the top two UPI players.

Vishwas Patel, Joint MD of Infibeam Avenues and Chairman of Payments Council of India (PCI), says that the continued growth and extension of UPI to the next 300 million Indians should be the sole aim of all stakeholders.

“Growth is life… We welcome the extension of the market cap of UPI apps by NPCI as we strongly believe that the Indian people themselves will choose from the dozens of new UPI apps available,” he said.

“Paytm is getting back to capturing its lost market share; Naavi, Cred, Bhim, WhatsApp Pay and many new apps are growing strongly. Banks are also getting their UPI app strategy in place. I strongly believe that in the next two years, the market itself will resolve this market cap issue. Blocking the growth of incumbents is not the right strategy and would have surely slowed UPI’s growth,” he added.

Level playing field

However, the smaller UPI players see the 30 per cent market cap as essential, saying every player has invested significantly in enabling seamless UPI service to customers.

“The market has enough options today for this decision to be taken. It can be taken incrementally, only for new users to start with and later extended to the rest,” says the founder of a large fintech firm. In the absence of the market cap and MDR, payments companies, especially UPI-heavy fintechs, are exploring lending partnerships with banks and shadow lenders for added revenue.

Bankers, too, are averse to the concentration risk, saying they have invested significantly to ensure no UPI transaction fails. A public sector bank CTO says the bank spends ₹50-60 crore each year towards maintaining and upgrading servers to handle the lakhs of monthly UPI transactions.

Industry players say the top two UPI service providers are backed by Walmart and Google, respectively, with deep pockets and can burn money to continue providing financial incentives to users, unlike their smaller peers.

“Everybody should be given a proper chance to grow. UPI is a public good. The NPCI is mandated with developing the payment infrastructure in the country,” a fintech association executive argues, adding that the status quo is not only bleeding banks but will also prove detrimental to end-consumers in the absence of competitive advantages.

Leave a Comment