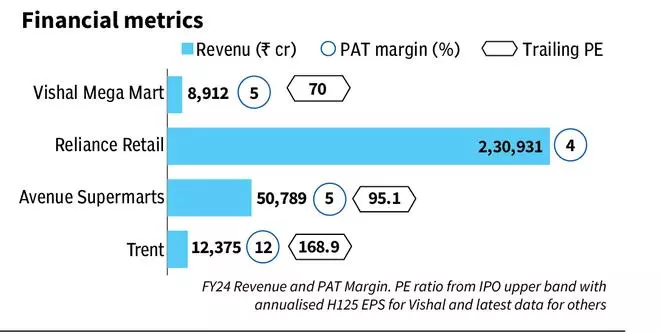

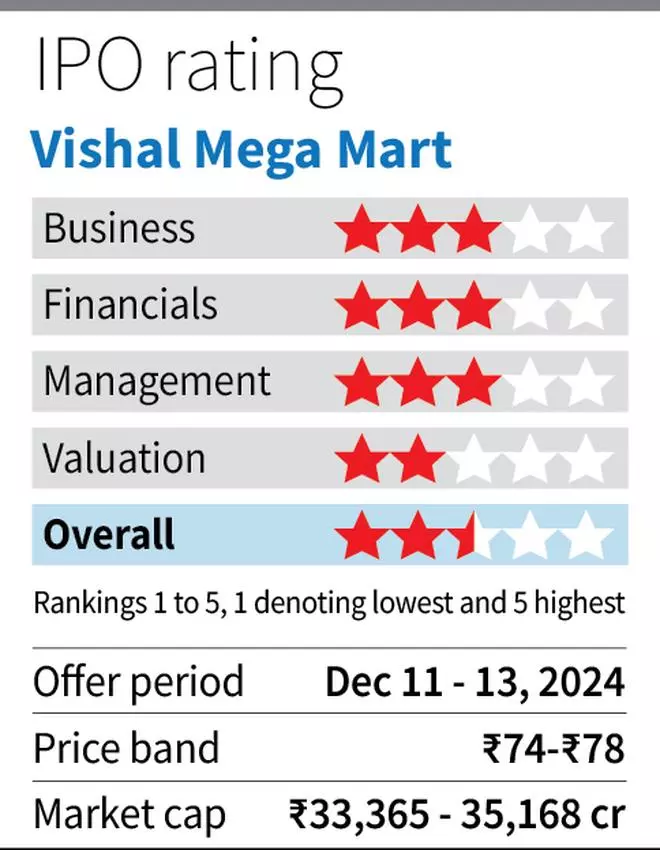

The ₹8,000 crore IPO of Vishal Mega Mart is underway and it will be open till December-13. The entirely offer for sale by the promoters will price the issue at a PE of 70 times annualized H1FY25 earnings. With tailwinds of rising income, shift to organized retail formats and higher urbanization, the retail industry commands a premium multiple currently. Avenue Supermarkets and Trent are currently trading at 95-169 times trailing PE. The IPO comes at a relatively lower valuation and scope for growth and a strong balance sheet are positives for Vishal Mega Mart (VMM). However, the valuation per se is not cheap. We recommend investors to wait and watch, ascertain the short-term headwinds to consumption, the competitive pressure from other organised retail players as well as commerce/quick commerce before investing in the stock.

- Also read: Vishal Mega Mart’s ₹8,000 cr IPO subscribed over 50% on Day 1

Background

The company was acquired in 2018 by the current promoters, Samayat Services LLP who are backed by the PE fund Kedaara Capital Fund II LLP. This acquisition was at a cost of ₹5,100 crores. The company was acquired from TPG Capital who themselves bought Vishal Retail, a discount retailer, when it was on the verge of bankruptcy in 2011 (no connection to current management).

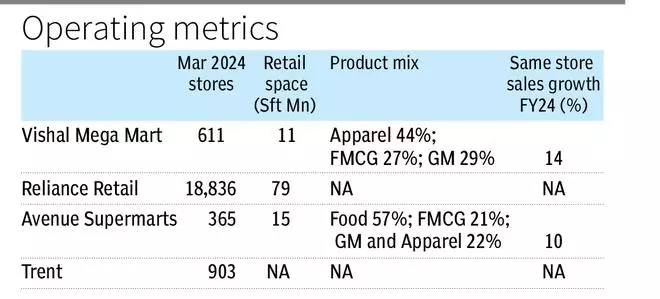

The company describes itself as ‘a one stop retail destination for middle and lower-middle income India’. The product mix is geared towards apparel (44 per cent of FY24 sales), FMCG (27 per cent) and General Merchandise or GM (29 per cent). Across categories, VMMs own brands account for around 75 per cent of the sales which are manufactured by third parties managed under contracts by VMM to ensure quality, consumer preference, cost, and reliability. VMM operates leasehold stores which along with third party manufacturing, makes for an asset light model.

The company is now on strong footing with healthy growth rates and presence in almost all states of the country and health balance sheet. At the upper price band, the company will be valued at ₹35,000 crore in the IPO.

Growth drivers and risks

The primary driver is net store addition. The company has added 56/54 stores in FY23/24 which is a 10 per cent store count addition. With a company estimated cost of ₹2 crore per store for refurbishment and ₹700 crore in net cash and investments as of Sep-24, the company has the financial base to power through store count addition at 50-60 stores per year in the medium term. On the demand side, the company targets Tier-II centers which are 70 per cent of its store count. This presents a strong runway for growth considering the rising urbanization of Tier-II centers and the vast number of untapped centres in the country. But the challenge can be from availability of appropriate real estate. The unorganized retail sector may also have a stronger presence in Tier-II cities posing a challenge to the middle income serving VMM format.

Indian retail experience dominated by unorganized sector, which accounts for 90 per cent of the market, provides scope for organized players. They offer pricing advantage, better customer experience, and a wide choice at one location. This favored VMM and other retailers who expanded their footprint rapidly. But the rise of quick commerce (Q-com) in FMCG and e-commerce in apparel and GM, is a rising threat. The recent Q2FY25 results commentary by FMCG companies and downward revision in earnings for Avenue Supermarkets might be tied to rise of Q-com. VMM points to own brand merchandise, presence in Tier-II markets and its own version of online sales with localized deliveries (0.5 per cent of FY24 sales) as offsets for the risk. But of note is that Q-com players are looking to expand beyond metros having tasted success in the latter. This should add to competitive intensity not only from online based players but also cannibalistion from existing offline chains with D-Mart driving into apparels and Zudio from Trent adding to available choices in the entry level price points again in apparel.

Financials and valuation

The company reported a revenue growth of 26 per cent in FY22-24 to ₹8,912 crore and reported 19 per cent YoY growth in H1FY25 ₹5,032 crore. The store count addition of 10 per cent YoY and same store sales growth of 14 per cent YoY which is industry leading, have helped deliver such growth. The company reports a PAT margin of 5 per cent which is inline with peers. The company has an asset light model with no debt but on the contrary is dependent on leasehold operations which adds to rental volatility.

At 70 times annualised H1FY25 earnings, VMM is relatively better compared to 95-169 times trailing earnings for Avenue and Trent. But considering the headwinds from Q-com, a possible slowdown in urban consumption and to store growth prospects, we recommend investors to wait now and enter the stock at lower valuations later on when the opportunity presents itself.

Leave a Comment