On a lazy Saturday afternoon, Abhishek and his friends decided to make tea and were dismayed to discover they had run out of tea leaves. No sweat. One of them tapped open a quick-commerce app — a platform promising grocery delivery within five to nine minutes. “What started as an emergency use has almost turned into an instinctive behaviour. Quick commerce has reduced my grocery runs to almost zero; I don’t even feel the need to stock up for a month,” says Abhishek.

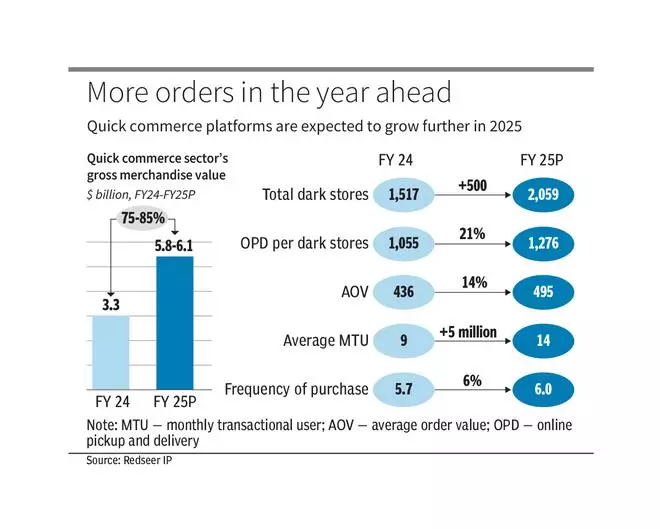

He is not alone, many are now turning to these platforms for a range of daily needs beyond just grocery. According to a report by Deloitte, the quick commerce market is expected to reach $5 billion by 2025; market intelligence platform Redseer notes that the segment’s expected growth rate is 75-85 per cent.

The leading quick commerce players include Blinkit, Zepto, Swiggy Instamart, and BigBasket, even as newer entrants such as Flipkart Minutes, Amazon and Tata throw their hats in the ring. With biggies entering the market, the question is, how will the sector evolve, and what will it take for players to stay competitive?

Growth levers

Increasing use of smartphones and affordable internet access have significantly expanded the digital ecosystem in India, making it easier for consumers to access quick commerce platforms. The growing number of urban households and rising disposable incomes have driven the demand for convenience such as quick commerce.

“India is one of the few markets growing rapidly, thanks to low levels of penetration in many categories and the increasing digital adoption by a younger, tech-savvy population. The big opportunity today is in the top metros. These cities represent about 65 per cent of demand for most FMCG categories, making them the backbone of quick commerce growth,” says Anand Ramanathan, partner (consumer products and retail sector leader), Deloitte India.

At the heart of quick commerce are the dark stores, which facilitate faster delivery and inventory management. A typical dark store serves customers in a 1-3 km radius.

Blinkit, which commands 40 per cent of India’s quick-commerce market, added 152 dark stores and seven warehouses in the September quarter, and now has 791 dark stores. Zepto, with 30 per cent market share, has 400 stores. Swiggy is looking to increase its Instamart dark store count from 609 in the September quarter to nearly 1,046 by March 2025, as well as increase their average size by 30-35 per cent.

Expanding SKUs

Together, the three companies account for 90 per cent of India’s quick commerce segment. All three are raising funds to launch more dark stores in more cities. They are also expanding their stock-keeping units (SKUs). “We’ve identified over 6,500 customer use-cases for grocery alone. To fulfil them, we need at least 13,000 SKUs. A growing assortment is essential to improve average order value and customer retention,” says Seshu Kumar Tirumala, National Head (buying and merchandising), BigBasket.

He notes that newer dark stores are being scaled up for larger assortments, with some reaching up to 25,000 SKUs. “Our larger dark stores now allow us to stock more products, leading to a 25 per cent higher average order value of ₹800-850 compared to the market average,” he adds.

Vinay Dhanani, President, Zepto, points out that data-driven SKU optimisation has enabled the company to stock high-demand products — from daily essentials to premium categories — tailored to regional and seasonal needs. “Zepto has achieved a leading position by leveraging over 600 strategically located dark stores to process nearly nine lakh daily orders, ensuring delivery within 10-15 minutes,” says Dhanani.

Newly added dark stores and higher average order value are attracting funding interest. Zepto, the only pure-play quick-commerce company, raised $1 billion between June and August and is looking to raise more. Swiggy raised ₹11,300 crore through an IPO, including around ₹4,500 crore in primary capital. Zomato’s board has cleared a plan to raise ₹8,500 crore through qualified institutional placement (QIP).

There are essentially three ways in which quick-commerce companies make money — discounts and commissions from suppliers; brand advertising revenue; and delivery, handling, and platform charges levied on customers. “Discounting in quick commerce will remain tactical,” notes Ramanathan. He adds that private labels fill gaps in quality, assortment, and affordability, and improve profit margins.

Zooming into tier 2

Quick commerce players are also looking to add more categories and penetrate into tier 2 cities and beyond. “Zepto has entered tier-2 markets like Vadodara, Kanpur, and Nashik — where we reached 1,000 daily orders per store in just six weeks. We are also diversifying into high-growth segments like consumer electronics, beauty products, and fresh meals, emphasising small, frequently purchased items. This operational density and targeted product mix are essential to sustaining growth and meeting evolving customer preferences,” says Zepto’s Dhanani.

As competition intensifies, there will be consolidation. And those who can adapt to the needs of customers will seize the opportunity. “Like in retail, where you now have just a few giants, quick commerce will also consolidate over time. By the end of the decade, we will see only a handful of major players,” Ramanathan says.

Another analyst notes that though some of the big players are entering the market late, they are leveraging their scale, logistics expertise, and existing customer base to catch up. “Amazon and Flipkart have scale and resources, but their late entry means they need to move quickly to establish a strong position,” he says.

India’s quick commerce sector is entering its next phase of evolution, shifting from proving its viability to building sustainable, competitive, and innovative business models.

Leave a Comment