The recent dip in Bitcoin price has sparked concerns among investors while triggering massive selling pressure in the broader crypto market. In addition, the recent market developments also hint towards a further dip, with many predicting a potential slip to $80K or even below. Notably, this comes despite the strong institutional interest in the flagship crypto, as evidenced by the buying spree of MicroStrategy (MSTR) and others.

Why Is Bitcoin Price Falling Today?

Bitcoin price has recorded a sharp decline today, sparking concerns in the broader crypto market. A flurry of reasons could have weighed on the investors’ sentiment recently, which has also triggered massive selling pressure in the digital assets space.

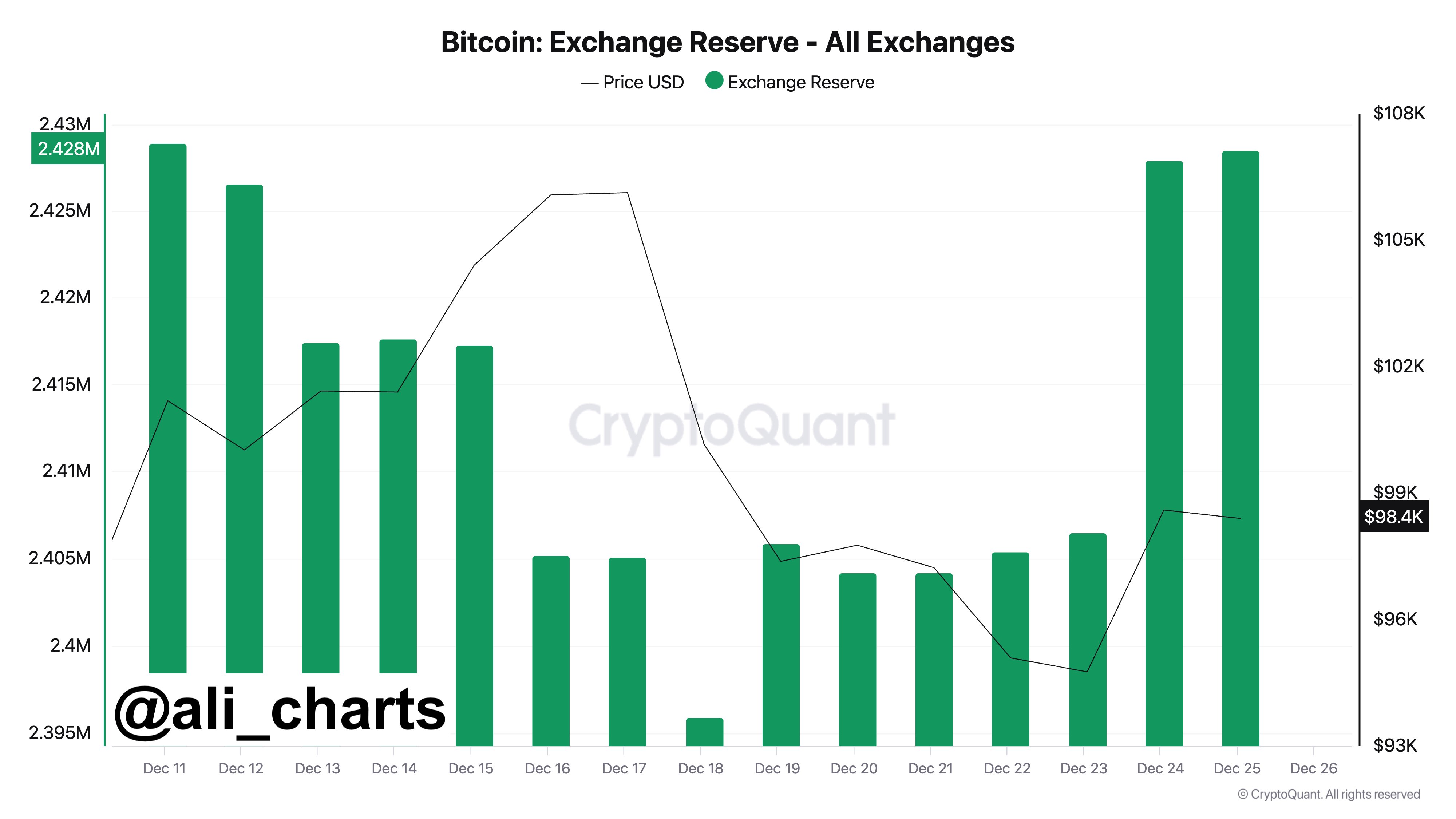

For context, BTC has recorded massive rallies since Donald Trump’s election win in November. Having said that, it also provided a profit-booking opportunity to many investors, with recent on-chain data indicating heavy selling pressure on the crypto. Top crypto market expert Ali Martinez highlighted the trend, saying that 33,000 BTC, worth over $3.23 billion, has moved to exchanges recently.

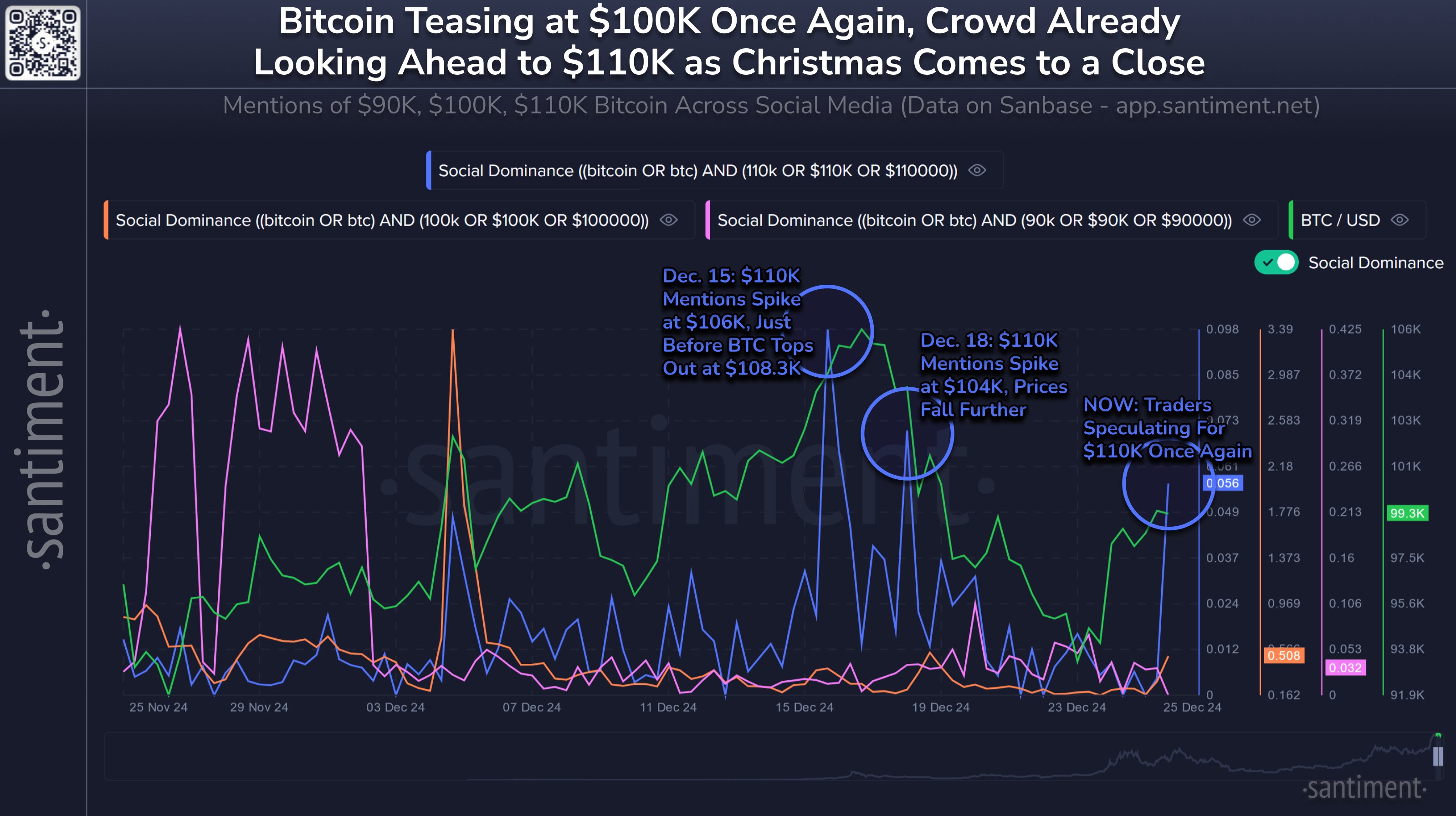

This indicates the profit-booking strategy, which the traders often use when an asset’s price goes higher. On the other hand, Santiment recently highlighted the BTC drop after reaching $99.8K on Christmas, sparked by bullish trader sentiment. The report noted that speculation of the cryptocurrency hitting $110K has also increased due to the recent rally.

However, Santiment suggests that historically, Bitcoin only reaches such highs when crowd expectations are low. This indicates that the current downturn may be a market correction, as traders’ high expectations for $110K may be self-fulfilling prophecies that prevent the price from rising further.

Bitcoin Options Expiry Sparks Concern

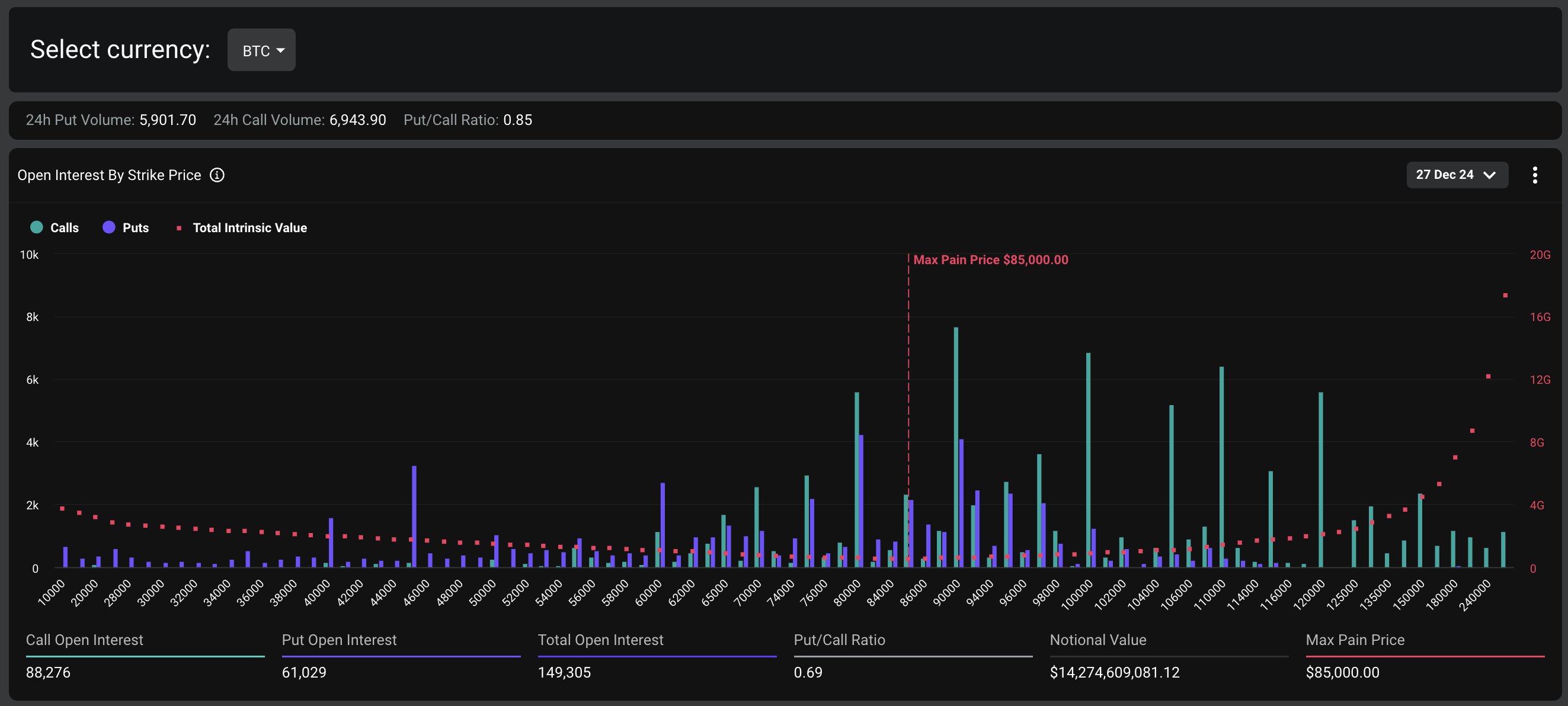

The recent downturn in Bitcoin price comes ahead of the largest crypto options expiry on the Deribit exchange, with over $18 billion in options set to expire tomorrow. The expiry has sparked directional uncertainty, with elevated volatility and “sharp swings in DVOL”, Deribit noted. Besides, market experts also warned that the heavily leveraged market to the upside could trigger a rapid snowball effect with any significant downside move, leading to high volatility.

Notably, the Bitcoin options expiry accounts for the majority of the total notional value, with $14.27 billion set to expire. The put/call ratio stands at 0.69, indicating a slightly bullish sentiment among traders. The max pain point for Bitcoin is $85,000, which could act as a resistance level in the event of a price swing.

On the other hand, Ethereum options expiring tomorrow account for $3.79 billion in notional value. The put/call ratio is 0.41, suggesting a more pronounced bullish bias among Ethereum traders. The max pain point for Ethereum is $3,000, which may influence the asset’s price movement.

BTC Dip To $80K Imminent?

The latest BTC price chart showed that the crypto plunged about 3.5% to $95,175, with its trading volume falling 1.5% to $42.45 billion. Notably, the crypto has touched a 24-hour high of $99,884, while maintaining a monthly gain of 2%. Further, BTC Futures Open Interest also fell about 3.5%, CoinGlass showed, indicating a bearish momentum hovering in the market.

Notably, the market picture indicates that despite soaring institutional interest, the recent developments have weighed on the market sentiment. For context, MicroStrategy (MSTR) stock recorded volatility recently amid its BTC buying strategy, which has fueled market speculations. Besides, many firms like KULR have also shifted their focus towards BTC accumulation.

Meanwhile, in a recent analysis, popular market expert Justin Bennett said that BTC is likely to fall to the $81K-$85K range. This analysis of Bitcoin price has fueled market concerns, with many other experts echoing a similar sentiment.

For context, Ali Martinez noted as Bitcoin dipped below the $97,300 mark, it indicates a bearish momentum for the crypto. However, he noted if BTC rebounds to this crucial support and rally to $100K, it could rally to $168,500 ahead.

Simultaneously, Peter Brandt has also predicted a potential BTC dip to $80K ahead, citing technical trends. On the other hand, popular market expert Tone Vays also said that if BTC trades below the $95,000 mark, it increases the probability of a correction to $75K.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Leave a Comment