- BRETT showed signs of declining interest as whale flows declined on the charts

- Healthy discount could potentially pave the way for liquidity injection

BRETT was one of the fastest growing memecoins in 2024. As such, it had all the makings of a memecoin that could potentially push into the top 5 memecoins list. However, the previously observed bullish momentum has since cooled down after a very bearish December.

In fact, IntoTheBlock data revealed that only 38% of BRETT holders were in the money at its $0.11 press time price level. Additionally, 50% of traders were out of the money and 12% were at the money. What this means is that a majority of holders purchased above the same price level.

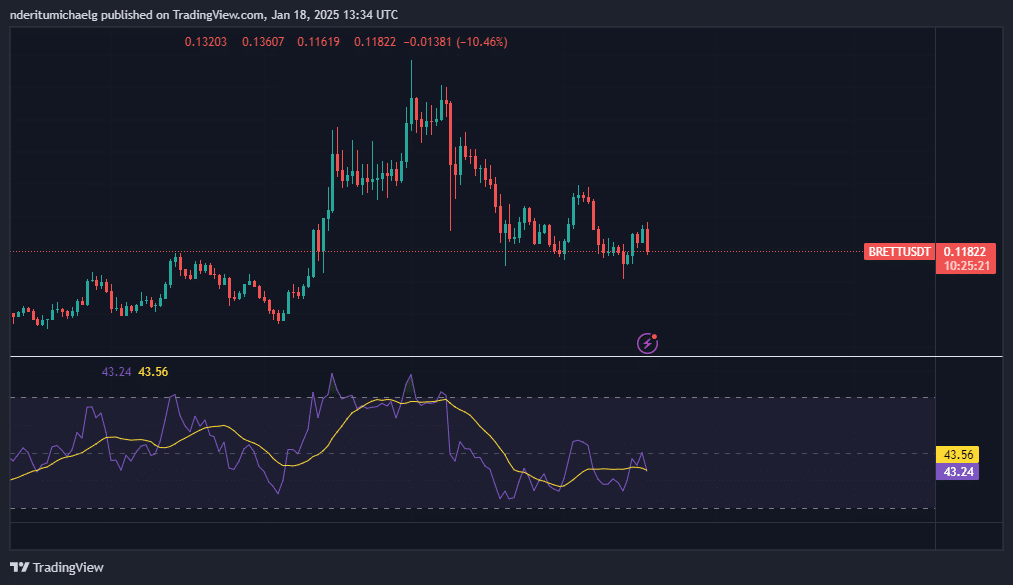

Its latest weekly performance also demonstrated a dip in large holder interest in the memecoin. Transactions worth over $100,000 fell from 1,727 TXs on 13 January to 138 TXs on 18 January. This was in line with the decline in large holder flows observed over the last few weeks.

Source: IntoTheBlock

Large holder inflows were down to 347.67 million BRETT while large holders dropped lower to 341.11 million BRETT. For comparison, large holder inflows peaked at 3.42 billion tokens on 12 December, while large holder outflows peaked at 3.40 billion tokens.

The large holder flows data confirmed the demand decline from whales, reflecting declining interest. As a consequence, BRETT was ranked 11th on Coingecko’s top memecoins by market cap list.

Can BRETT drum up enough demand at consolidation zone?

The decline reflected heavily in BRETT’s price action which, at press time, was down by 50% from its December peak. It even failed to secure a significant bounceback at the 0.5 to 0.618 Fibonacci zone.

Source: TradingView

On the other hand, BRETT has also been showing signs of consolidation near its press time price range. Now, could this kick off a wave of accumulation this week? Well, its discounted price level may seem attractive for investors. However, on-chain data has been flashing some mixed signals.

For example – BRETT saw a slight uptick in positive funding rates in the last 24 hours. This suggested that traders in the derivatives segment may anticipate some upside. There was also a significant uptick in Open Interest from $70.63 million to $86.82 million in the last 3 days.

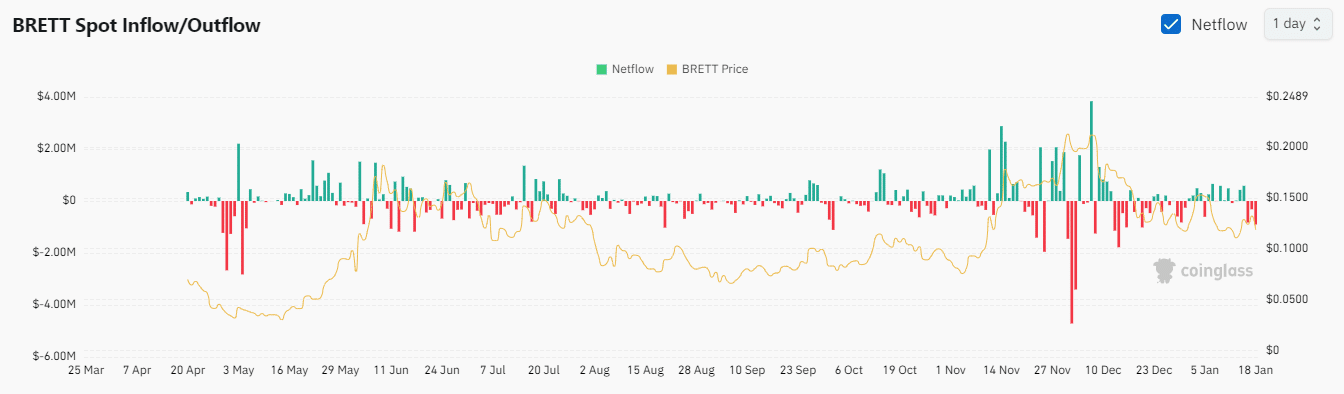

However, BRETT spot flows remained largely negative over the same period.

Source: Coinglass

BRETT recorded just over $902,000 worth of spot outflows in the last 24 hours. This could mean that it does not take much to move the price.

The return of demand from whales could potentially trigger another sizeable rally. Especially now that memecoins are receiving a lot of attention.

Source: https://ambcrypto.com/why-brett-memecoins-short-term-targets-will-be-dictated-by-whale-action/

Leave a Comment