Solana (SOL) plummeted to a two-month low on Monday, mirroring a broader cryptocurrency market downturn led by Bitcoin’s decline. While SOL has since recovered slightly, gaining 2%, the impact remains significant, with over $21 million in long liquidations recorded in the past 24 hours.

With strengthening bearish pressure, long positions in the SOL futures market remain at risk.

Solana Long Traders Count Their Losses

During Monday’s intraday session, SOL’s price plunged to a 68-day low of $168.88, driven by Bitcoin’s drop below the critical $90,000 support level. Although SOL has since recovered slightly, long positions in its derivatives market remain under significant liquidation pressure.

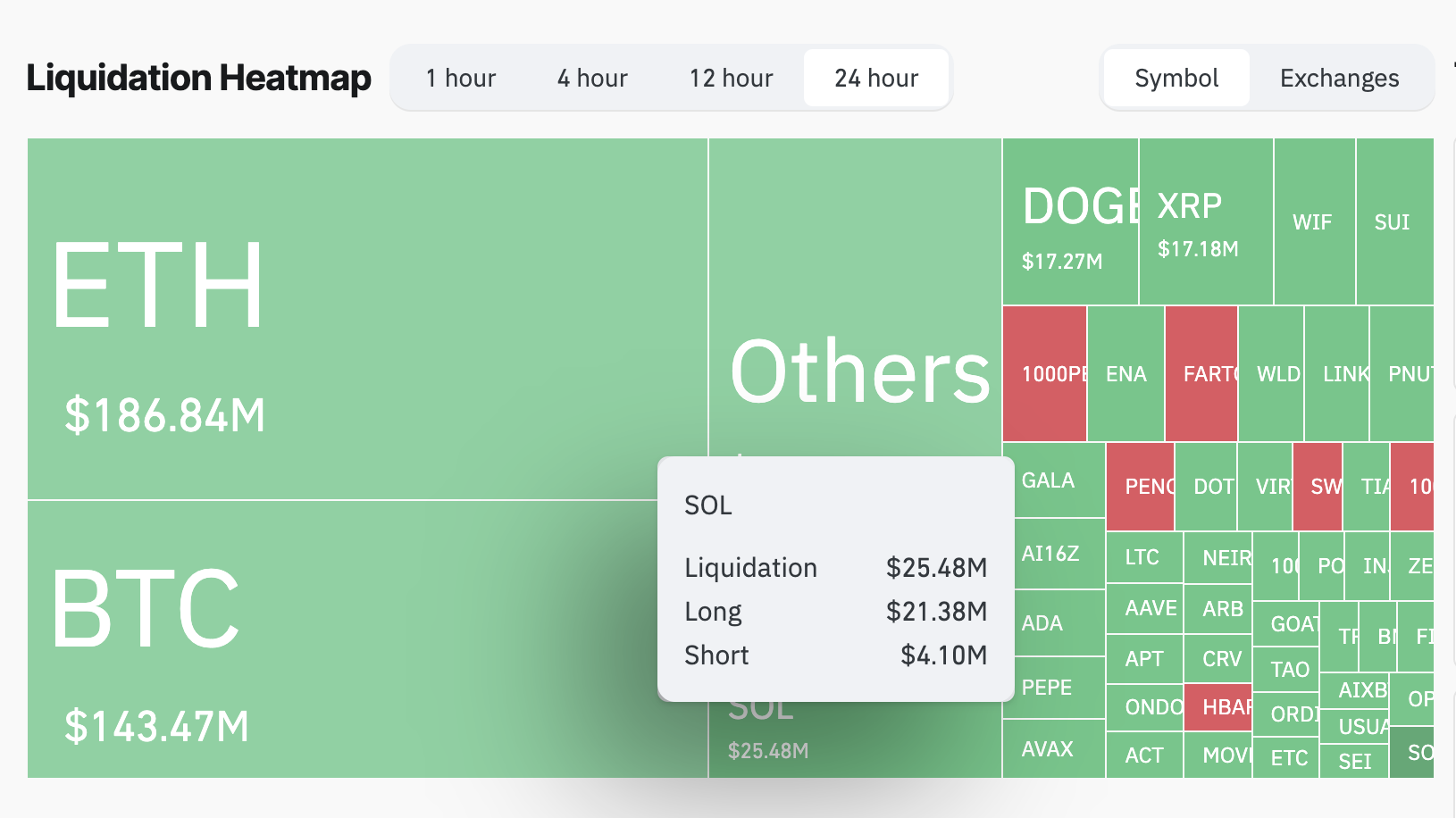

According to Coinglass, over the past 24 hours, the total liquidations in the Solana market have reached $25.48 million, with long liquidations accounting for $21.38 million and short liquidations totaling $4.10 million.

Liquidations occur when an asset’s price moves against a trader’s position. In such cases, the trader’s position is forcefully closed due to insufficient funds to maintain it.

As with SOL, long traders are compelled to sell the asset at a lower price to cover their losses when the price declines.This usually occurs when the asset’s price falls past a threshold, forcing traders betting on a price increase to exit the market.

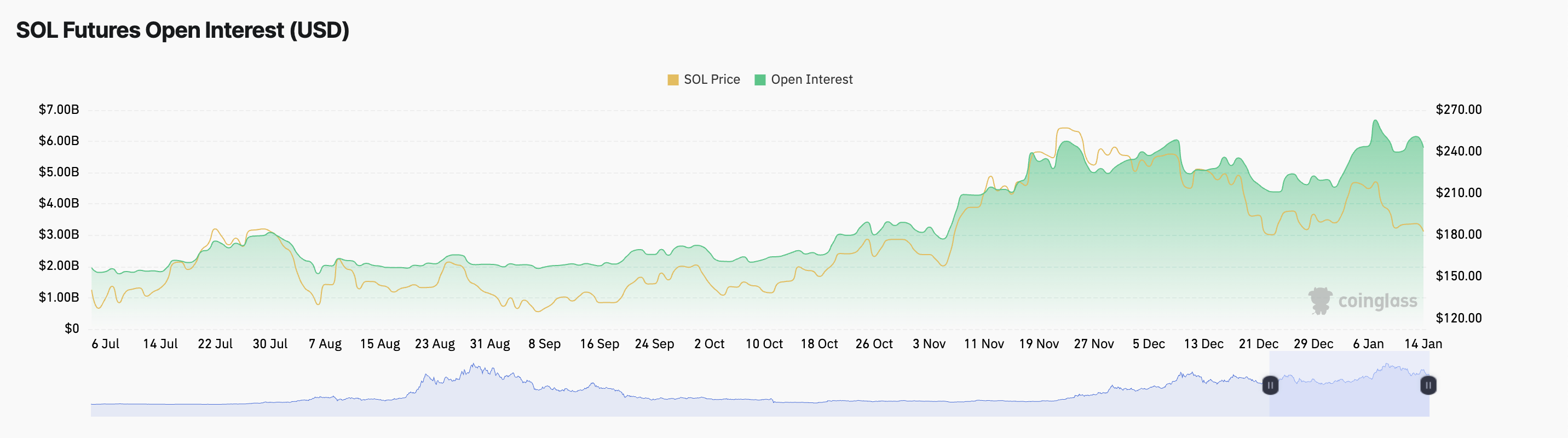

Due to this, SOL’s derivatives traders have begun to close their positions, evidenced by the coin’s declining open interest. In the past 24 hours, this has dropped by 3.47%.

Open interest tracks the total number of outstanding futures and options contracts that have not yet been settled. A decline in an asset’s open interest signals that traders are closing their positions, which can indicate a reduction in market activity and a potential dip in the asset’s value.

SOL Price Prediction: The $188.96 Resistance Is Key

With increasing bearish pressure, SOL may struggle to break above the critical $188.96 resistance level. If sell-offs intensify and SOL resumes its downward trend, its price could drop to $170.41, resulting in the liquidation of more long positions.

On the other hand, if bullish sentiment strengthens and the coin breaks above $188.96, it could rally towards $218.90.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Leave a Comment