As the number of affluent and high net worth individuals (HNIs) rises rapidly in India, the demand for more sophisticated products, services and investment advice becomes increasingly strong.

Asset managers who can cater to a range of wealthy clients via comprehensive offerings stand to gain from the trend.

Nuvama Wealth Management is one such well-entrenched firm that operates in three key divisions – wealth management, capital markets mainly and a fast-growing asset management – with entrenched offerings in each of these segments. It has client assets worth ₹4.41 lakh crore as of September 2024.

The company offers proprietary products and also distributes third-party products. It also offers wealth advisory, institutional investor access, exchange-traded products and investment banking services.

It caters to a range of clientele — affluent, HNIs, UHNIs, family offices, corporates and institutions.

A diversified revenue mix with all divisions in healthy growth mode, superior yields from its assets and strong profitability metrics are positives for the company.

At ₹7,012, the stock trades at around 22 times its likely per share earnings for FY25. This price earning multiple is lower than listed mutual fund companies that trade at 27-37 times.

Being deeply linked to the market dynamics, financial services stocks, including those of wealth management firms, can correct more than the broader indices.

Therefore, investors with a medium to high-risk appetite can buy the stock with at least a two-three-year perspective.

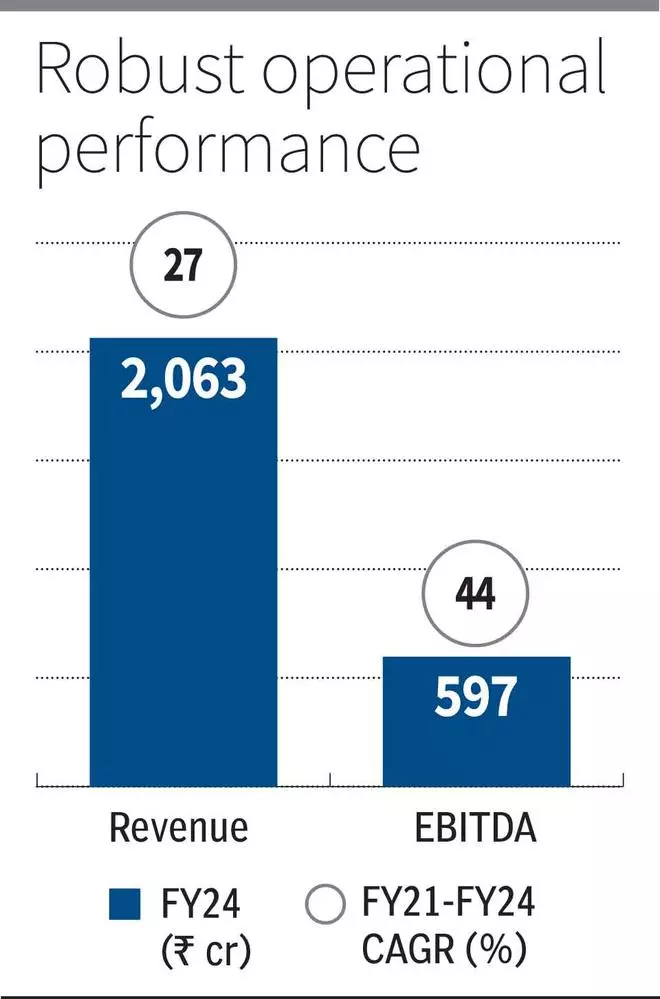

In the three years leading to FY24, Nuvama’s revenues grew at a compounded annual rate of 27 per cent to ₹2,063 crore, while net profits rose at 44 per cent over the same period to 597 crore in FY24. In H1FY25, revenues rose 55 per cent over H1FY24 to ₹1,407 crore, while net profits almost doubled to ₹479 crore.

The company has a strong return on equity of 31.5 per cent as of H1FY25. Over the years, Nuvama has also managed to bring down its cost to income ratio from 73 per cent in FY21 to 62 per cent in FY24, which has further reduced to 54 per cent as of H1FY25, which improves profitability.

The yields on assets are north of 85 basis points and often exceed 90 basis points, which are nearly twice that of what mutual funds make from their own AUM.

Growth drivers

The wealth management division of Nuvama offers fixed income, structured products, alternates, portfolio management services, equity, credit, mutual funds, and insurance of third parties. Distribution of financial products, short-term funding for employee stock option schemes, margin trade financing facility and broking services are rendered.

Thus, the company is able to offer a wide range of bespoke advisory and investment solutions to clients of varying degrees of affluence via relationship managers and external wealth managers.

This segment contributes 47.4 per cent of the company’s revenues.

The wealth division has client assets worth more than ₹1 lakh crore (up 53 per cent YoY in H1FY25), while the private client segment has ₹2.05 lakh crore in assets (up 35 per cent YoY in H1FY25).

These divisions ensure strong fee income for the company that can grow sustainably over the years.

PMS and AIF assets in India are worth ₹18.87 lakh crore as of June 2024. According to a PMS Bazaar estimate, these assets are expected to grow to ₹100 lakh crore by 2030.

Also, there is a rising number of wealthy individuals in the country gaining from start-up funding/listing and stock options from growing and established local and global companies, apart from businesspersons.

Thus, there is long runway for growth in the case of established players such as Nuvama Wealth Management.

The capital markets division is the other key segment for the company contributing to over half the revenues.

This division offers institutional equities (investment research, trading desks with multiple platforms, access to listed and unlisted companies, and proprietary exchange-approved algorithms), and investment banking and advisory services. It also provides asset services – fund setup advisory, securities custody, derivatives clearing, fund accounting, reporting and fiduciary services to a range of clientele including AIFs, PMS, FPIs, family offices and HNIs.

The capital markets division saw revenues grow by a whopping 120 per cent YoY in H1FY25 to ₹707 crore. Profit before tax for the segment grew even faster in the same period, at 247 per cent.

Nuvama also has a relatively tiny asset management division that offers AIF and PMS products to investors. In all, there are eight strategies offered. This division has ₹10,288 crore in AUM as of H1FY25, up 67 per cent YoY. Revenue from the segment has grown at a rate of 59 per cent over FY22-24. Fee-paying client assets have risen 77 per cent in H1FY25.

Overall, the company, with its broad-based offerings, appears to be on course to strong growth on all key metrics if markets remain reasonably buoyant.

Leave a Comment