- XRP is in a high-stakes tug-of-war, setting up a potential short squeeze

- If it materializes, FOMO could fuel a surge of new investors flocking to XRP as BTC consolidates

XRP seems to be losing its grip. Despite its real-world use cases, FOMO-driven rallies, and whales buying the dip, the token has dropped by 8% over the past week, entering a sharper decline on the charts.

On the bright side, XRP Ledger activity is up, with network velocity highlighting a sharp uptick. Will this spark a comeback though? Or is a deeper pullback looming on the horizon? With the broader market under strain, caution might be key.

Disclosing the volatility in the derivatives market

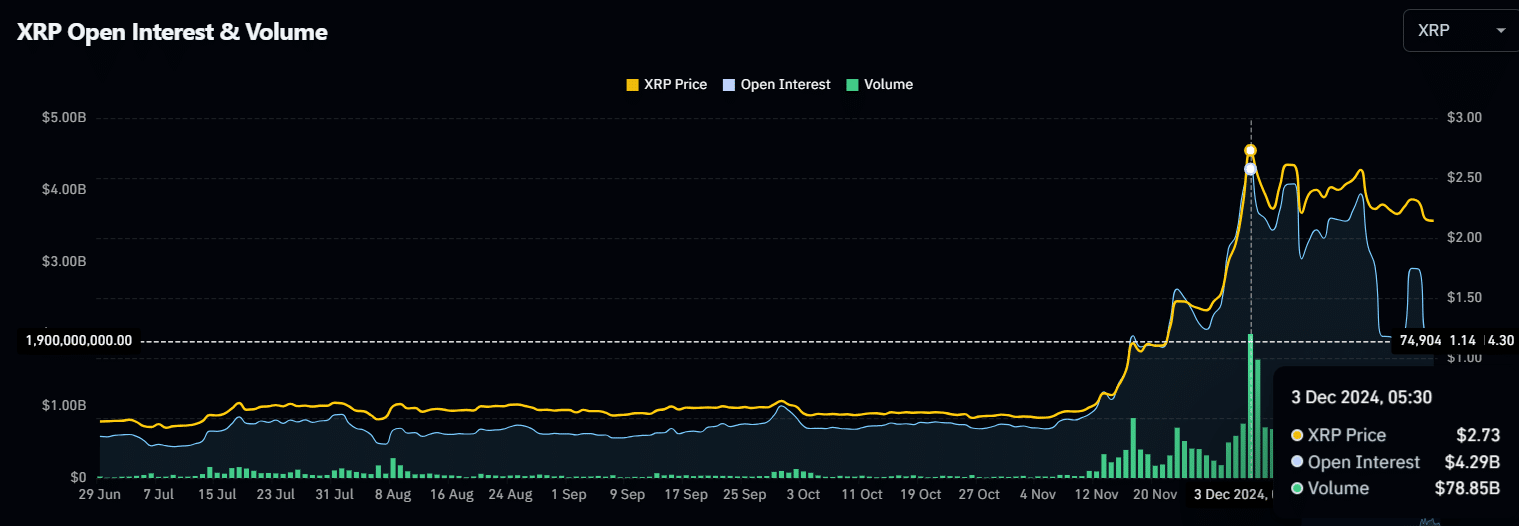

The “Trump pump” pushed XRP to nearly $3 – Its highest point in three years – sparking a frenzy among Futures traders. In fact, the Open Interest (OI) surged to a record $4.29 billion as investors piled in, betting on further price gains.

Source : Coinglass

However, the market quickly flipped, leaving the market’s bulls scrambling. Long positions were wiped out in a brutal long squeeze and now, the OI has crashed to $1.97 billion – A staggering 54% drop in less than a month. In just 24 hours, $2.66 million in long positions were liquidated out of a total $2.93 million.

The trend is clear – Shorts are taking over. As the delta shifts into the red, short sellers are betting heavily on further declines, pushing XRP deeper into its downward spiral. So, with the bears firmly in charge, the outlook for XRP looks increasingly bleak, at least in the short-term.

There is a silver lining for XRP

Unlike other top altcoins that have seen their post-election gains vanish, XRP still holds a solid base of investors in profit. The recent break of two key levels has kept FOMO alive and well. However, if the bearish trend continues and XRP dips below the crucial $2 threshold, panic could take hold. Fear of further losses might trigger a cascade of sell-offs, sending XRP into a more aggressive downturn.

On the daily chart, XRP flashed clear signs of an overheated market when it surged to $2.80 after the elections. With a streak of long green candlesticks lighting up the chart for weeks, it was only a matter of time before profit-taking kicked in.

Now, XRP finds itself in a high-stakes tug-of-war – Whales are fighting to keep the price stable, while sellers are looking to cash out. Interestingly, this tension might be setting the stage for a bullish move down the road.

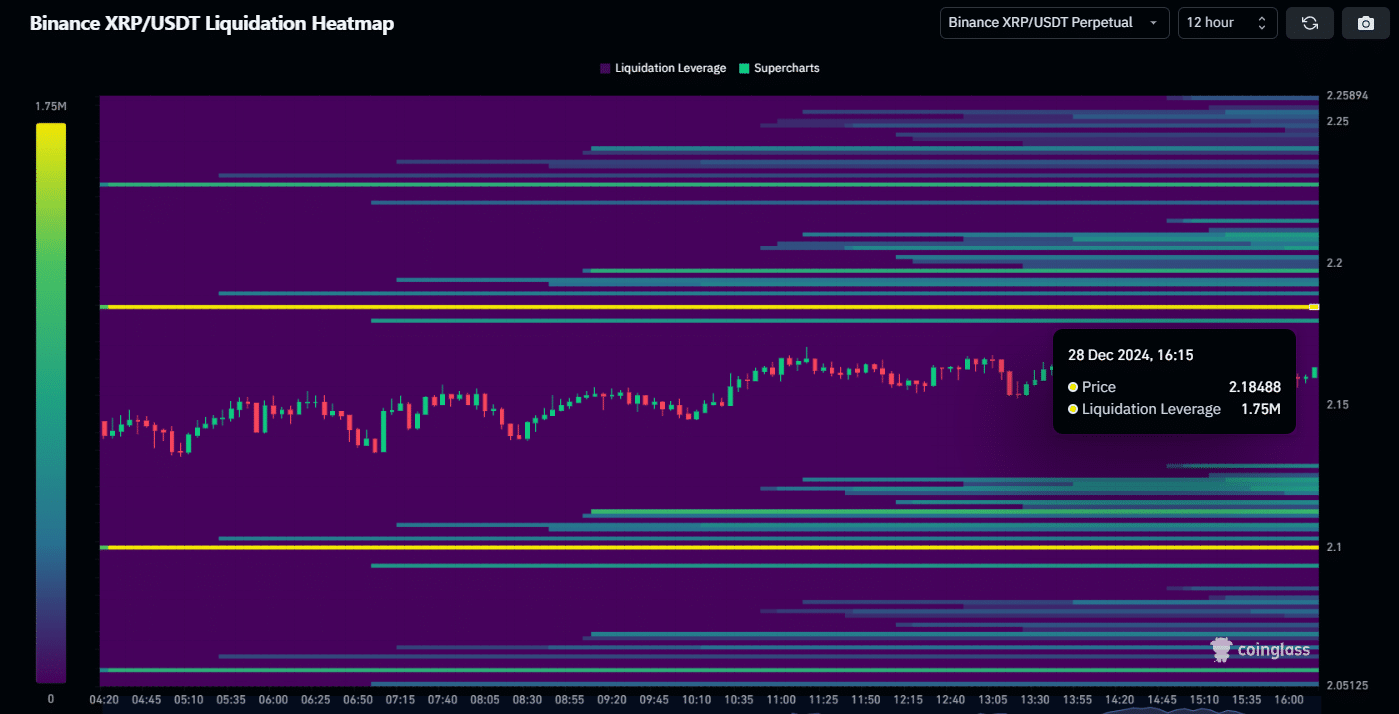

Source : Coinglass

Zooming in on the 12-hour chart, we can see a strong liquidity pocket at $2.18, where 1.75 million leveraged positions seemed to be at play. If XRP can hold this level, it could spark a rebound, creating the perfect storm for a short squeeze.

Read XRP’s Price Prediction 2025–2026

This presents a rare opportunity for savvy investors looking for a ‘dip’ buying chance, especially as BTC consolidates. If XRP holds strong, it could be primed to take the lead, offering potential for a strong rally ahead.

Thus, this could be the moment for those looking to diversify into altcoins while the market remains in flux.

Source: https://ambcrypto.com/xrps-volatility-exposed-why-now-might-be-the-time-to-buy-the-dip/

Leave a Comment